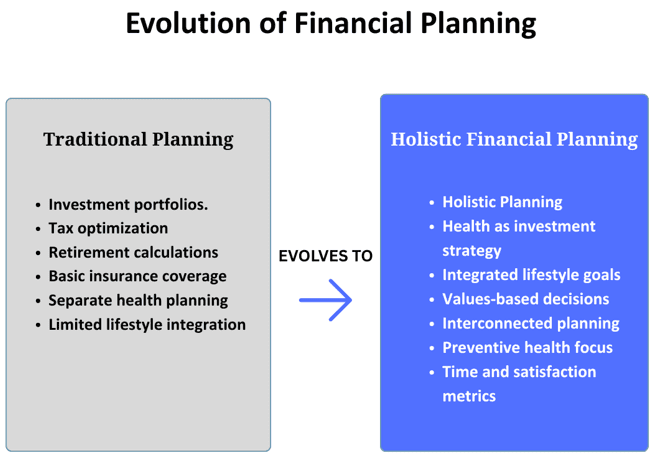

There was a time when financial planning included investments, taxation strategies, and retirement calculations. However, time has changed, and financial planning has become more comprehensive. Holistic financial planning includes everything related to money, from your investments to your health and lifestyle goals.

If you are also wondering how to do holistic planning, you have come to the right place. In this article, we will cover everything you need to know about with a step-by-step process.

What is Holistic Financial Planning?

Holistic financial planning connects your health status, financial resources, and lifestyle choices under one plan. The three components of holistic financial planning are:

Health Capital: Your physical and mental wellbeing, preventive care practices, genetic factors, and healthcare access.

Financial Capital: Your monetary resources, including income, investments, insurance, debt management, and future earning potential.

Lifestyle Capital: Your time allocation, living environment, relationships, work satisfaction, personal growth, and day-to-day choices.

Traditional financial planning typically focuses almost exclusively on financial capital – growing investments, minimising taxes, and ensuring adequate retirement funds. Health enters only through insurance conversations, and lifestyle is reduced to a spending budget.

This limited approach misses critical connections. A high-stress career that damages health might generate impressive income but create medical costs that offset the financial gains. This is just an example of how lifestyle choices impact health and health impacts overall finances.

Health in Holistic Planning

The financial value of good health manifests in multiple ways:

Earning Potential: Healthy individuals experience fewer work disruptions, higher productivity, and often longer careers. This translates directly to increased lifetime earnings.

Healthcare Cost Reduction: Preventive care costs a fraction of treatment. Regular health screenings, proper nutrition, stress management, and physical activity dramatically reduce the likelihood of expensive chronic conditions.

Insurance Optimisation: Better health qualifies you for lower insurance premiums across multiple categories, life, health, and even disability coverage.

Extended Independence: Maintaining health reduces the need for costly assisted living or nursing care in later years.

Healthcare inflation consistently outpaces general inflation in India at a 14% rate annually. Even a minor chronic condition can derail an otherwise solid financial plan.

As a result, a holistic approach treats health maintenance as an investment strategy. Beyond insurance, comprehensive medical contingency planning includes building an emergency fund, understanding and saving for coverage limitations and out-of-pocket maximums, and building an explicit plan for managing serious illness or disability

Wealth in Holistic Planning

Wealth in holistic planning extends beyond portfolio balances and net worth calculations. It includes all resources that provide security, opportunity, and the capacity to live according to your values.

Purposeful wealth accumulation starts with clarifying what money actually means to you. Is it security? Freedom? The ability to help others? Different answers lead to dramatically different strategies.

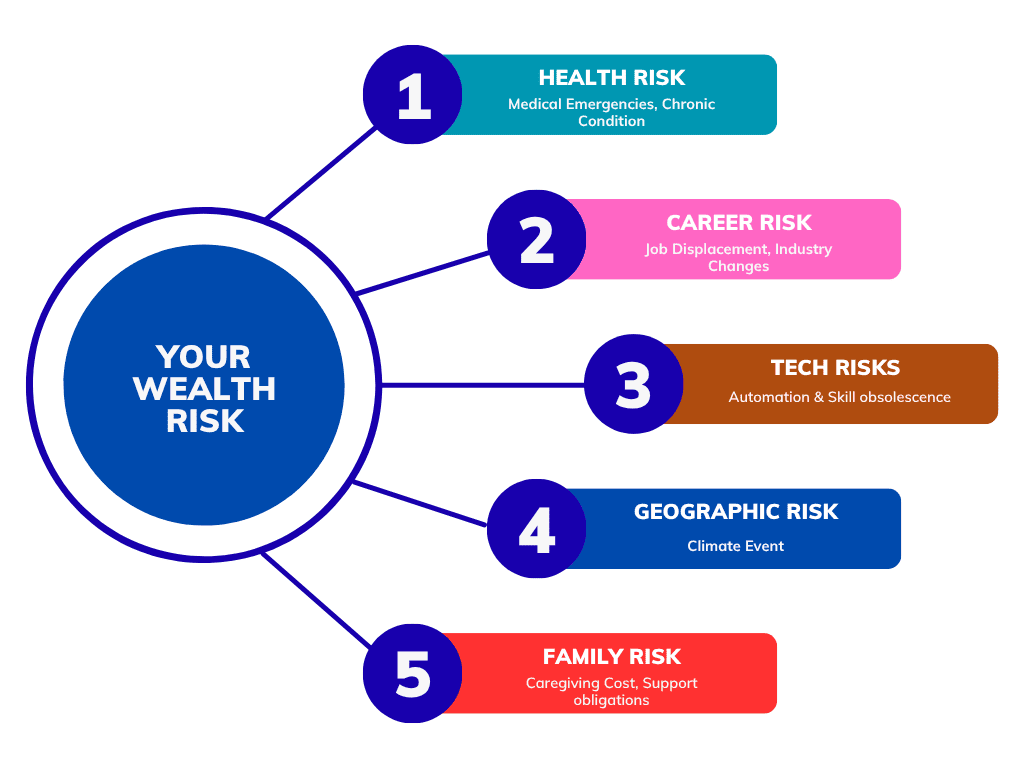

Wealth here also means that you consider related risks in your planning that can potentially impact your wealth, such as:

Health risks and their financial implications

Career disruption possibilities

Family caregiving responsibilities

Geographic and environmental factors

Technological disruption of industries and skills

Based on this, you can make decisions that impact your wealth creation journey.

Lifestyle Goals in Holistic Planning

Lifestyle isn’t what you do with money that’s left over after saving. It’s a core component of your financial plan. Your daily choices about time, location, relationships, and activities have profound financial implications.

Identifying lifestyle priorities starts with an honest assessment of what truly satisfies you. You need a balance between your current lifestyle and your future lifestyle with the choices you make today.

Holistic planning doesn’t prescribe universal answers but creates a framework for making these trade-offs intentionally rather than by default. Strategies for incorporating lifestyle goals include:

Identify true priorities and life goals

Time auditing to align time allocation with stated goals

Regular assessment of satisfaction levels with your lifestyle choices

Creation of specific metrics for lifestyle goals alongside financial targets

How to Create a Holistic Plan?

1. Comprehensive Assessment

Begin with a thorough evaluation of your current status across:

Health: Not just medical conditions, but energy levels, recovery time after stress, sleep quality, family health patterns, and fitness capabilities

Wealth: Beyond basic finances, assess income stability, career trajectory, hidden liabilities, insurance gaps, and asset concentration risks

Lifestyle: Document how you actually spend time (not how you think you do), relationship quality, living environment impact, and sources of daily friction

This baseline assessment identifies both strengths to leverage and gaps to address.

2. Values and Goals Clarification

Define what truly matters to you across all three segments:

What does “good health” specifically mean to you?

What purpose do you want your financial resources to serve?

What daily living experience would bring satisfaction?

What trade-offs are you willing to make across these areas?

Document these priorities with as much specificity as possible. Vague goals produce vague results.

3. Holistic Mapping

Now, you need to identify how each segment influences the others in your specific situation:

Track exactly how work stress manifests in physical symptoms and spending patterns

Identify specific lifestyle choices directly impacting both health markers and financial outcomes

Map how financial constraints create health compromises and lifestyle limitations

Find the reinforcing loops where improvements in one area automatically enhance others

This mapping process often reveals unexpected connections.

4. Strategic Planning

Develop specific strategies that optimise across all three segments of your life:

Create income approaches that generate wealth without compromising health

Design spending patterns that align with both values and long-term financial security

Build investment strategies that support your specific life goals, not just maximum returns

Implement protection systems for health, wealth, and lifestyle simultaneously.

5. Implementation Timeline

Create an implementation plan that you can achieve realistically:

Identify the foundation changes that enable everything else

Schedule high-impact, low-effort improvements first to build momentum

Create 30-60-90 day milestone checkpoints with specific outcomes

Prepare for the inevitable implementation dips with pre-planned responses

Small, consistent steps outperform dramatic overhauls every time.

6. Monitoring the Process

Track what actually matters, not just what's easy to measure:

Health metrics: Both clinical markers and daily energy/stress indicators.

Financial vital signs: Cash flow patterns, spending alignment, and progress metrics

Lifestyle indicators: Time allocation reality, relationship quality, and values expression

Schedule regular reviews of all metrics together rather than in isolation.

7. Adjustment When Needed

Define in advance how you’ll handle gaps between expectations and reality:

Define specific threshold breaches that demand immediate attention

Establish which metrics override others when conflicts emerge

Create decision frameworks for responding to unexpected opportunities or setbacks

This prevents reactive decision-making during stressful periods.

Holistica financial planning is very different and has more nuances from simple financial planning, as you need to consider multiple factors. As a result, you should consult a certified financial advisor or expert.

Conclusion

Holistic financial planning isn’t just a superior approach to managing money. It’s a fundamentally different understanding of what financial planning aims to accomplish. The compounding benefits of holistic planning can make a huge difference.

Small improvements in health increase earning capacity and reduce costs. Aligned lifestyle choices increase both financial outcomes and health status. Remember, financial security means little without the health to enjoy it and a lifestyle that brings fulfilment.

The path to holistic planning starts with a simple question: What do you want your resources, financial, physical, and temporal, to actually accomplish in your life? Everything else follows from there.

Get a Free Financial Health Check-up Today!

Take the first step towards better financial planning.

Click the link below to get your quick financial health check done