Choosing the right health insurance for your family is an important decision that affects your financial security and peace of mind. In India, two main types of policies are available: family floater policies and individual health insurance policies.

Each type has its own features, benefits, and drawbacks. These differences can affect which option is best for your family's size, health history, and financial situation. As healthcare costs continue to rise, knowing these differences is key to making informed decisions in 2026 and beyond.

Here, we will cover all you need to know about both these insurance policies and help you make an informed decision.

Understanding the Basic Difference

A family floater policy provides a single sum insured that covers all family members collectively. The total coverage amount is used by all insured individuals, no matter who incurs medical expenses. For example, if the policy offers ₹10 lakhs as the sum insured, this is the maximum amount that can be claimed by any or all family members in a policy year.

On the other hand, individual policies allocate a separate sum insured to each family member. Each insured person has an independent coverage limit, meaning a ₹10 lakh policy for each member effectively multiplies the total coverage by the number of insured individuals.

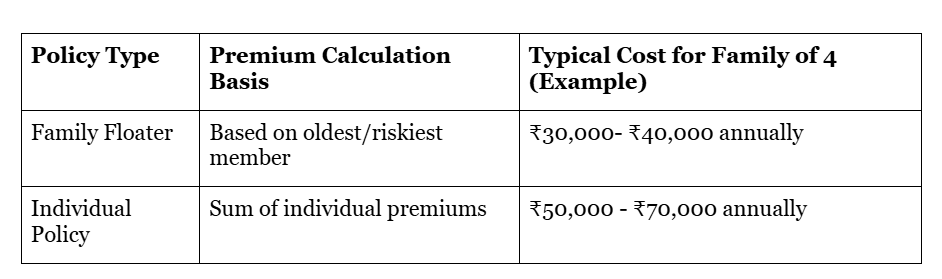

The Premium Calculation

Family floater policies usually cost less than individual policies for each family member. This is because the insurance company puts everyone together and expects that not all members will need to make a claim at the same time. Individual policies set premiums based on the age, health, and risk profile of each member.

Consequently, the total premium for individual policies can be substantially higher, especially for older or high-risk members.

The Family Factor: Who Benefits From What

Let us see which insurance type suits different individuals based on their life stage and preferences.

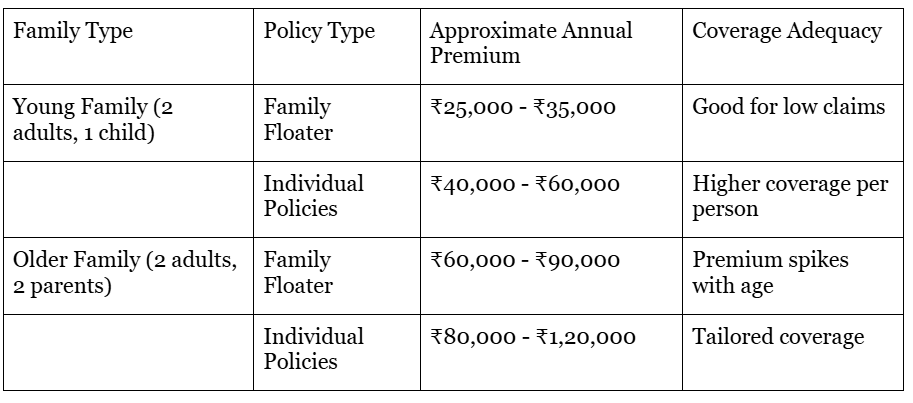

Young Families vs Older Ones

Young families with fewer health issues and lower claim probabilities often benefit from family floater policies due to cost efficiency and simpler management. The risk of multiple simultaneous claims is lower, making shared coverage practical.

Older families or those with members above 50 years may find individual policies more suitable. Age-based premium increases and higher claim likelihoods can make floaters less cost-effective and riskier due to shared limits.

Including parents in a family floater often leads to significant premium hikes because insurers price the policy based on the oldest member’s age and health profile. This can diminish the cost advantage of floaters.

In such cases, purchasing separate individual policies for parents or opting for specialised senior citizen health plans may be more economical and provide better coverage.

The Health History Impact

Pre-existing conditions influence underwriting and premium rates. Family floaters typically require all members to meet health criteria, and the presence of chronic illnesses can increase premiums or lead to exclusions.

Individual policies allow tailored underwriting per member. Members with pre-existing conditions can be insured separately with customised terms, avoiding penalisation of healthier family members.

The Growing Family Consideration

For families planning to expand, family floaters offer flexibility by allowing the addition of newborns and dependents without purchasing new policies. This simplifies administration and maintains unified coverage.

Individual policies require separate policies for each new member, which can increase administrative effort and overall premium costs.

The True Cost Comparison: Real Numbers Across Different Family Types

Let us have a look at how family floaters and individual policies fare in terms of cost.

While floaters offer cost savings, the shared sum insured can limit coverage in high-claim years, especially if the insurer does not offer an automatic top-up. Individual policies provide guaranteed coverage per member, enhancing financial protection but at a higher cost.

Over time, premiums for both policy types increase due to age and inflation. Family floaters may see sudden premium jumps when older members are added, or age thresholds are crossed.

Individual policies allow staggered premium increases and selective renewal, enabling better long-term cost management, especially for families with varying health profiles.

What’s Changing in the Insurance World?

Here is what is changing in this sector and how it impacts you as a policyholder.

The New Policy Features: Insurers are enhancing both family floaters and individual policies with features like wellness programs, no-claim bonuses, and coverage for outpatient treatments, improving value propositions. Some floaters now offer sub-limits per member to mitigate the risk of coverage depletion, blending the advantages of both models.

Online Management and Claims Processing Improvements: Digital platforms have streamlined policy purchase, premium payments, and claim settlements for both policy types, increasing transparency and convenience. Mobile apps and AI-driven claim assessments reduce turnaround times, benefiting policyholders regardless of policy structure.

The Rising Hospital Costs: Healthcare inflation continues to outpace general inflation, increasing claim amounts and premiums. Choosing a policy with adequate sum insured and inflation protection riders is critical, with individual policies often providing more tailored options.

Making the Right Choice for Your Family

Now that we have covered the basics, let's talk about how to pick the right policy for your family.

The Decision Framework

Look at your family size, ages, health, and finances first. If you have a younger and healthier family, a family floater policy can save you money. If your family is older or has health issues, individual policies might be a better choice.

How Much Insurance Your Family Actually Needs

Calculate your expected medical expenses. Keep in mind that costs can rise and emergencies can happen any time. Make sure your insurance covers hospital stays, tests, and outpatient care.

The Hybrid Approach

Some families benefit from using a family plan for younger members while choosing individual plans for older or at-risk members. This helps balance costs and coverage.

Build Flexibility as Your Family Changes

Review your policies every year. Update your coverage as your family grows or your health changes. You can consider switching or supplementing policies to maintain optimal protection.

Conclusion

Both family floater and individual health insurance plans have benefits and drawbacks. Choosing the right one depends on your family's makeup, health conditions, financial goals, and how much risk you can handle.

Family floater plans are usually more affordable and flexible, making them a good choice for younger and healthier families. On the other hand, individual plans give focused protection and stability, which is better for older or members with complex health issues.