Once Albert Einstein stated, “Compound interest is the eighth wonder of the world. He who understands it, earns it; he who doesn’t, pays it.” This statement captures the essence of what makes investing so powerful.

Yet many investors struggle to visualise exactly how this “eighth wonder” works in practical terms and how it can help their money grow. If you are on the same boat, the Rule of 72 can be helpful. It helps you calculate when your investment will double. This is not a gimmick but a legit mathematical formula, which we are going to cover in this article.

Understanding the Mathematics Behind the Rule of 72

The Rule of 72 dates back to the 15th century and was first documented in Luca Pacioli's important math book "Summa de arithmetica," published in 1494.

Pacioli, known as the father of accounting, described it as a rule that merchants and financiers in Renaissance Italy were already using.

The formula works by dividing the number 72 by your expected annual rate of return:

Years to double = 72 ÷ Annual rate of return (%)

This works because it closely estimates the natural logarithm function that precisely calculates compound growth.

While mathematically the exact formula uses ln(2)/ln(1+r), which equals approximately 69.3 for low rates, the number 72 was likely chosen for its convenience in mental calculations, as it has many divisors (1, 2, 3, 4, 6, 8, 9, 12, 18, 24, 36, 72).

When an investment doubles, it is a 100% return on your initial capital. This means your money has effectively reproduced itself.

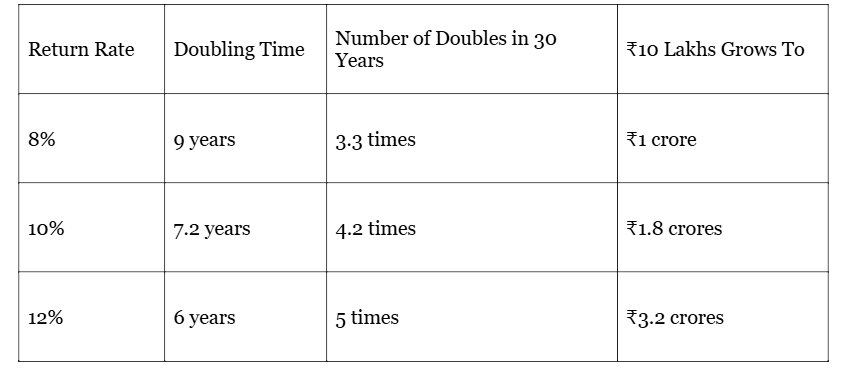

Consider this:

First doubling: ₹1 lakh grows to ₹2 lakhs (100% gain).

Second doubling: ₹2 lakhs grows to ₹4 lakhs (300% of the original amount).

Third doubling: ₹4 lakhs grows to ₹8 lakhs (700% of the original amount).

Fourth doubling: ₹8 lakhs grows to ₹16 lakhs (1,500% of the original amount).

SIP vs. Lump Sum Analysis

The Rule of 72 works for both systematic investment plans (SIPs) and lump sum investments, but there is a key difference. For lump sum investments, the doubling time applies to the total amount invested. For example, if you invest ₹10 lakh at a 12% return, it will grow to about ₹20 lakh after 6 years, no matter how the market changes.

With SIPs, each payment has its own schedule for doubling. Your first contribution might double in about 6 years, while your last one has just started growing. This means that different contributions will double at different times.

For a monthly SIP of ₹20,000, contributions made in the first month would double in 6 years, while later contributions would double over progressively shorter periods.

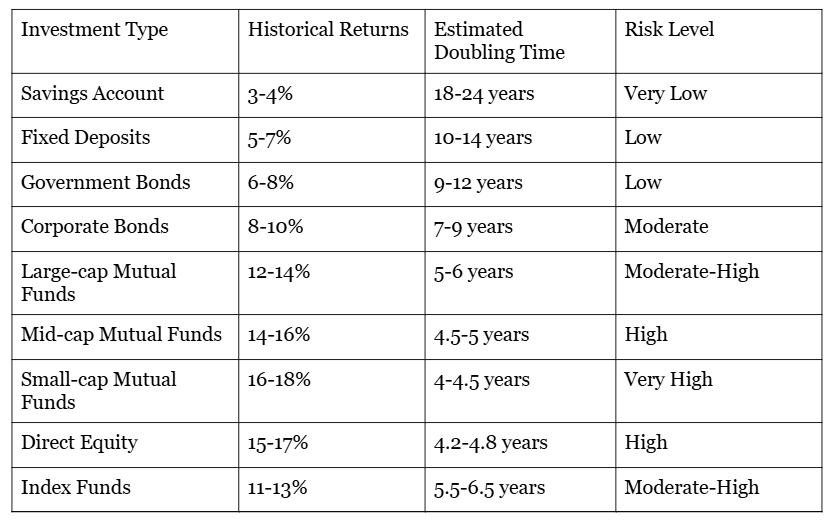

Comparing the Rule of 72 for Different Instruments

This will help you understand how your money would double in each of these instruments.

Factors to Consider for Making Better Investment Decisions

To make informed investment decisions, here are the main factors to consider:

1. The Power of Small Percentage Increases

The Rule of 72 shows how small improvements in return rates create outsized impacts on wealth accumulation:

Investors need to carefully look at fees and expenses. Even a small change, like a 1% drop in returns (from 10% to 9%), can significantly impact how long it takes to double your money.

This change extends the doubling time by nearly a year, from 7.2 years to 8 years.

2. Risk-Return Correlation

The Rule of 72 helps investors quantify whether higher risk is justified by faster doubling. For example, if a high-risk investment offers 15% expected returns versus 12% for a moderate-risk option:

High-risk option: 72 ÷ 15 = 4.8 years to double

Moderate-risk option: 72 ÷ 12 = 6 years to double

The investor must decide if the additional risk is worth shaving 1.2 years off the doubling period.

3. The Compounding Visualisation

Understanding precise doubling periods helps investors maintain discipline during market volatility. By visualising that a 12% return will double investments every 6 years, investors can better contextualise short-term market fluctuations against their long-term doubling timeline.

This perspective often prevents panic selling during downturns, as investors can focus on the doubling horizon rather than temporary market conditions.

Beyond Doubling: Extended Applications of the Rule

Is there anything beyond the Rule of 72 to know the speed of wealth creation? The answer is yes! Here are a few more such rules to help you.

1. The Rule of 114: Calculating When Your Money Will Triple

Just as the Rule of 72 estimates doubling time, the Rule of 114 approximates when your investment will triple:

Years to triple = 114 ÷ Annual rate of return (%)

114 ÷ 12 = 9.5 years to triple

2. The Rule of 144: Determining Quadrupling Timelines

To estimate when your investment will quadruple in value:

Years to quadruple = 144 ÷ Annual rate of return (%)

144 ÷ 12 = 12 years to quadruple

This is mathematically equivalent to two consecutive doublings, as the Rule of 72 would predict 6 years to double and another 6 years to double again (12 years total).

3. The Reverse Application: Finding Required Return Rate

The Rule of 72 can be inverted to determine what return rate you need to achieve a specific doubling goal:

Required return rate (%) = 72 ÷ Desired years to double

If you want your money to double in 8 years:

This application is particularly valuable for retirement planning, allowing investors to calculate the returns needed to reach specific wealth milestones.

Inflation Adjustment in the Rule of 72

In high-inflation environments, nominal returns can be misleading. To calculate your real doubling time, use your inflation-adjusted return:

Real Return = Nominal Return - Inflation Rate

For example, if your investment returns 12% but inflation is 6%:

This means while your money nominally doubles in 6 years, its purchasing power doubles in 12 years.

Conclusion

The Rule of 72 is one of finance's simplest tools that can help you make investment decisions. It provides investors with a framework for comparing opportunities, evaluating risk, and visualising the power of compound growth.

While no rule can predict market performance with certainty, the Rule of 72 offers A perspective. “Someone’s sitting in the shade today because someone planted a tree a long time ago.” The Rule of 72 shows you exactly how long that tree will take to grow, and gives you the confidence to plant it today.”