Today, stock market volatility has become as predictable as monsoon rains. With that, the human tendency to capitulate under pressure has also become one of the most significant obstacles to building wealth.

What is the result? Panic selling! It leads to liquidating assets during market downturns due to fear rather than fundamental analysis. At a deeper level, we can also connect it with psychological triggers, which hinder the process of long-term wealth creation. In this article, we will cover all you need to know about the psychology of panic selling and how you can avoid it.

What is the result? Panic selling! It leads to liquidating assets during market downturns due to fear rather than fundamental analysis. At a deeper level, we can also connect it with psychological triggers, which hinder the process of long-term wealth creation. In this article, we will cover all you need to know about the psychology of panic selling and how you can avoid it.

How Your Brain Processes Market Crashes

The stock market crash of February 28, 2025, is an example. When the Sensex plummeted by over 1,400 points in a single session, trading volumes surged dramatically as retail investors rushed to exit. This dine, triggered by global trade tensions and domestic economic concerns, showcases how external events can become triggers for investors.

This was not the first time. During the 2020 COVID-19 crash, the Sensex fell 3,935 points (13.2%) on 23rd March alone, as pandemic fear overwhelmed rational assessment. Similarly, the 2008 global financial crisis saw the Sensex drop in half, from approximately 20,000 points to below 10,000 points, as many investors liquidated their positions.

What connects these episodes is not just market mathematics but human psychology, specifically, our innate tendency to prioritise immediate psychological comfort over long-term financial outcomes. This behaviour is beyond education levels, affecting even sophisticated investors during periods of heightened market stress. Here are the top reasons:

When markets plummet, our primitive amygdala, responsible for processing fear and emotional responses, hijacks the prefrontal cortex, which handles rational decision-making. This neurological override transforms even disciplined investors into panic-driven reactionaries.

Neuroimaging studies reveal that financial losses activate the same brain regions as physical pain, explaining why market declines can trigger such visceral reactions. The brain’s threat-detection system cannot differentiate between financial dangers and physical ones, creating disproportionate emotional responses to market volatility

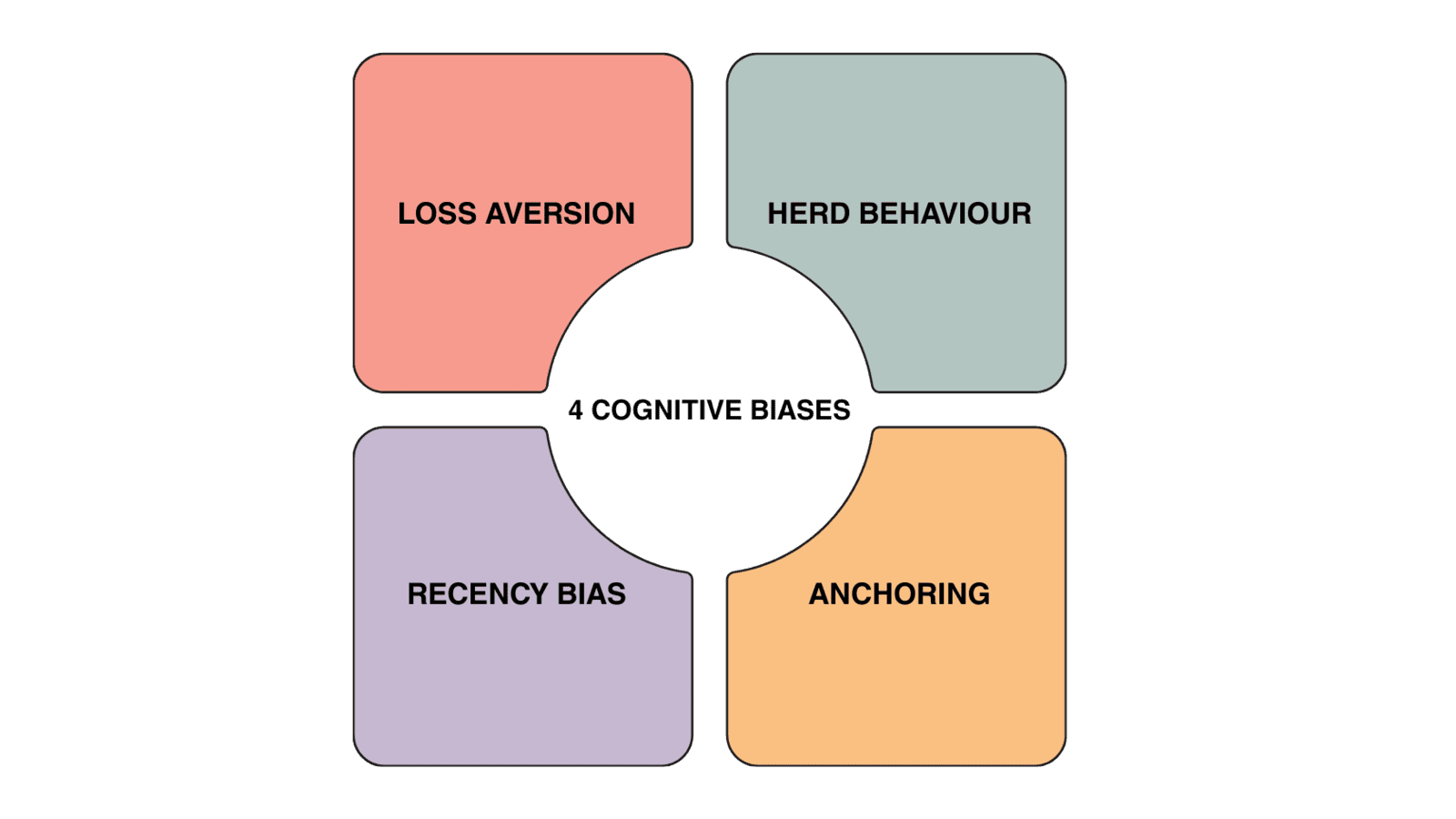

Four Key Cognitive Biases

There are also cognitive biases that affect investment decisions:

Loss Aversion: Prospect theory, pioneered by Kahneman and Tversky, demonstrates that humans feel losses approximately twice as intensely as equivalent gains. This asymmetric response explains why Indian investors frequently abandon sound long-term strategies during market corrections.

Herd Behaviour: The collective movement of investors magnifies individual psychological tendencies. In Indian markets, where community and family connections often influence investment decisions, this bias becomes particularly potent. The Harshad Mehta scam of 1992, which wiped out wealth worth ₹1 lakh crore, showed how collective momentum transforms individual rationality into mass hysteria.

Recency Bias: Investors disproportionately weigh recent events when forecasting future outcomes. After the February 2025 crash, many retail investors projected continued decline despite contrary economic indicators, extrapolating short-term volatility into permanent conditions.

Anchoring: The tendency to fixate on arbitrary reference points, usually purchase prices, creates psychological barriers to objective analysis. Many investors refuse to sell losing positions, waiting for recovery to their “anchored” purchase price, while paradoxically selling winners too early.

Information Overload

India’s rapid digitalisation has created a unique psychological challenge for investors. Financial news, once delivered through weekly publications, now arrives through instantaneous notifications, which can create different emotions, including anxiety. Investment communities on platforms like WhatsApp and Telegram can magnify both optimism and pessimism beyond rational levels.

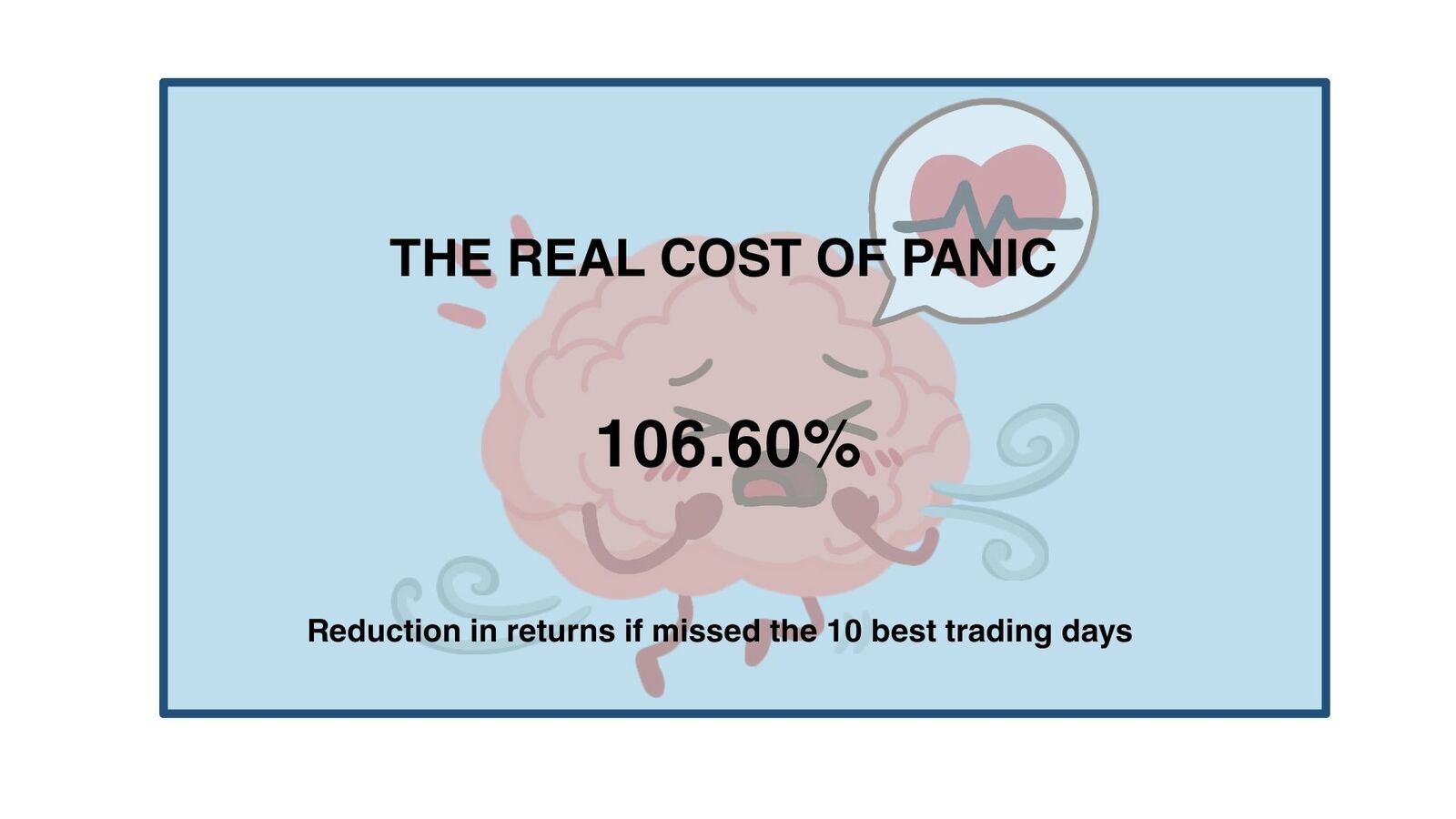

Build Your Psychological Defense System

The financial mathematics of panic selling reveals its cost. Analysis of Indian market data since 2000 shows that missing just the 10 best trading days would have reduced returns by approximately 106.60%. This opportunity cost arises because market recoveries often begin unexpectedly and concentrate gains in brief periods following significant declines. To avoid such consequences, here are some pointers.

Here’s how to create mental safeguards that protect your wealth during market turbulence:

Portfolio Design as Psychological Insurance

Your investment structure should anticipate emotional weakness, not just financial goals:

The sleep-well reserve: Maintain 6-12 months of expenses in liquid assets. This creates genuine security, knowing market volatility cannot affect your immediate needs. During the 2025 correction, investors with adequate cash reserves were nearly three times less likely to sell equities at market lows.

Honest risk assessment: Many investors overestimate their emotional tolerance for volatility. Ask yourself: “How did I actually behave during previous market drops?” rather than “How would I theoretically behave?” If you found yourself anxiously checking your portfolio hourly during the last 20% market decline, your portfolio likely contains more risk than your psychology can handle, regardless of what risk tolerance questionnaires suggest.

Automation over emotion: Remove decision-making during emotional periods by:

Setting up automatic rebalancing that triggers at predetermined thresholds.

Creating scheduled investment plans that continue regardless of market conditions.

Using systematic withdrawal strategies rather than ad-hoc selling.

Psychological income buffers: Include investments that generate regular income (dividends, interest). These provide emotional reassurance during downturns; seeing actual cash flow despite price declines significantly reduces selling pressure.

Managing Your Information Environment

Your information consumption shapes your emotional responses more than market movements themselves:

Scheduled market check-ins: Most investors check portfolios and markets far too frequently, increasing anxiety without improving results. Implement a strict schedule, once weekly for most investors, monthly for truly long-term investors. During volatile periods, many successful investors temporarily delegate portfolio monitoring to advisors, checking results only after predetermined periods to avoid emotional decisions.

Quality over quantity: Information sources that prioritise:

Long-term perspective on daily movements

Fundamental analysis over technical predictions.

Historical context over dramatic headlines.

Educational content over actionable “tips”.

Create a volatility information plan: Develop specific guidelines for information consumption during market drops:

Reduce financial media consumption by 50% during corrections (10%+ drops).

Eliminate intraday price checking during bear markets (20%+ drops).

Increase consumption of historical context (reading about past recoveries).

Consult only predetermined, trusted sources rather than searching broadly.

Reframing Market Declines as Opportunities

Train your brain to see market declines differently through specific mental practices:

“If the market drops 10%, I will invest ₹X from my reserve fund”

“During corrections, I will increase my monthly SIP by 25% for three months”

These rules transform your emotional experience; you begin looking for opportunities during volatility rather than reasons to exit.

Replace daily price checking with quarterly earnings reviews

Focus on dividend payments rather than price fluctuations

Review company fundamentals rather than technical indicators

Historical data shows that extreme pessimistic sentiment has consistently marked excellent entry points for long-term investors.

Developing a True Long-Term Perspective

The ability to think in years rather than days fundamentally changes investment psychology:

i. Goal-based Mental Compartments

Retirement assets (20+ year horizon)

Children’s education (5-15 year horizon)

Major purchases (2-5 year horizon)

This mental organisation reduces the emotional impact of short-term volatility on long-term assets.

Your core investment beliefs

How markets have rewarded patient investors

Your commitment to long-term thinking

Review this document immediately whenever you feel the urge to make emotional decisions.

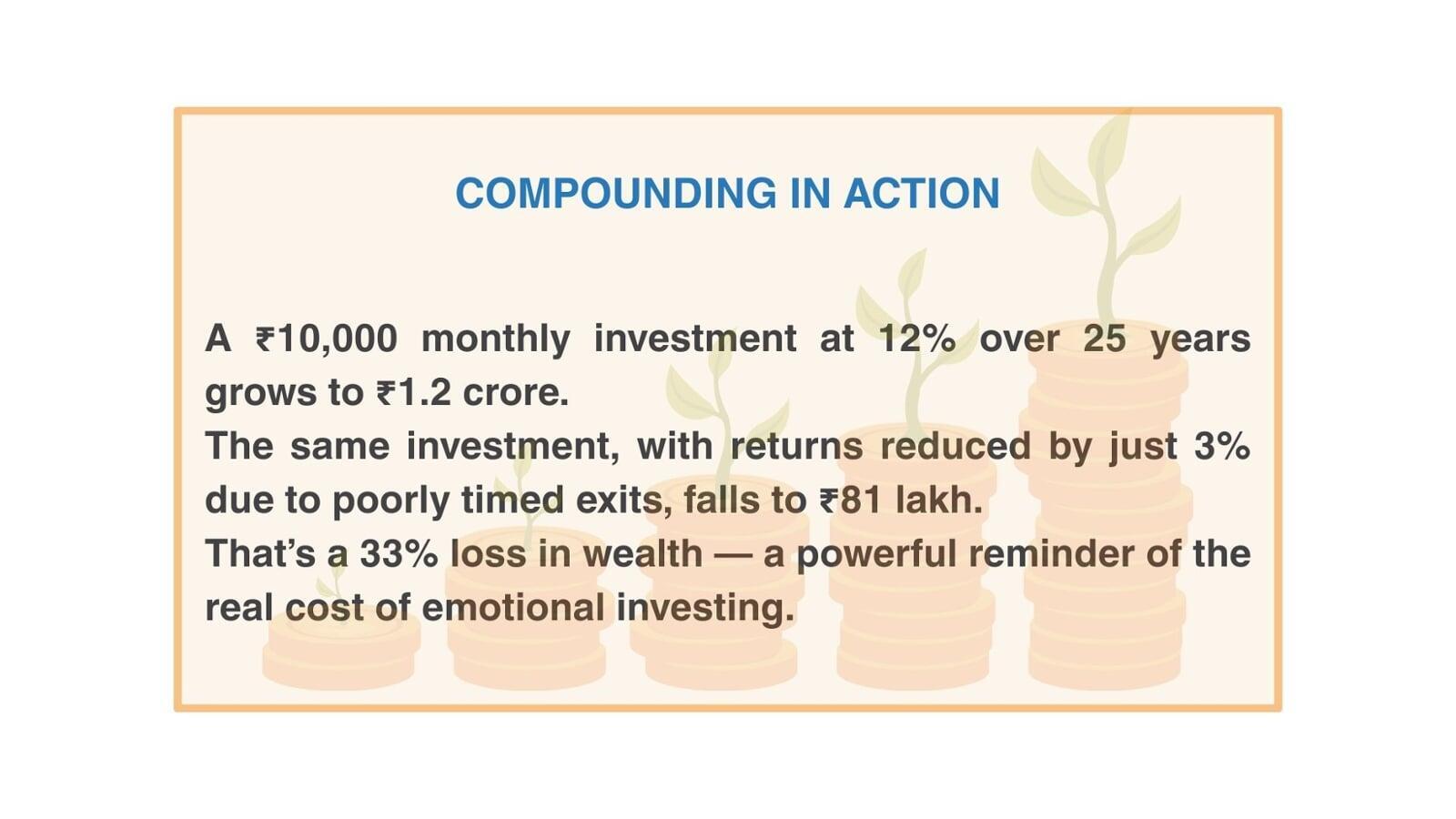

₹10,000 monthly investment growing at 12% over 25 years = ₹1.2 crore.

The same investment with just 3% less return from poorly timed exits = ₹81 lakh.

This 33% reduction in wealth makes the cost of emotional decisions tangible and personal.

Conclusion

While markets will continue their unpredictable journey, your response to them remains entirely within your control.

By implementing the defensive systems outlined in this article, you transform market volatility from a source of fear into a consistent mechanism for wealth creation. The most successful investors aren’t those with superior market knowledge; they’re those who have mastered their own psychology.