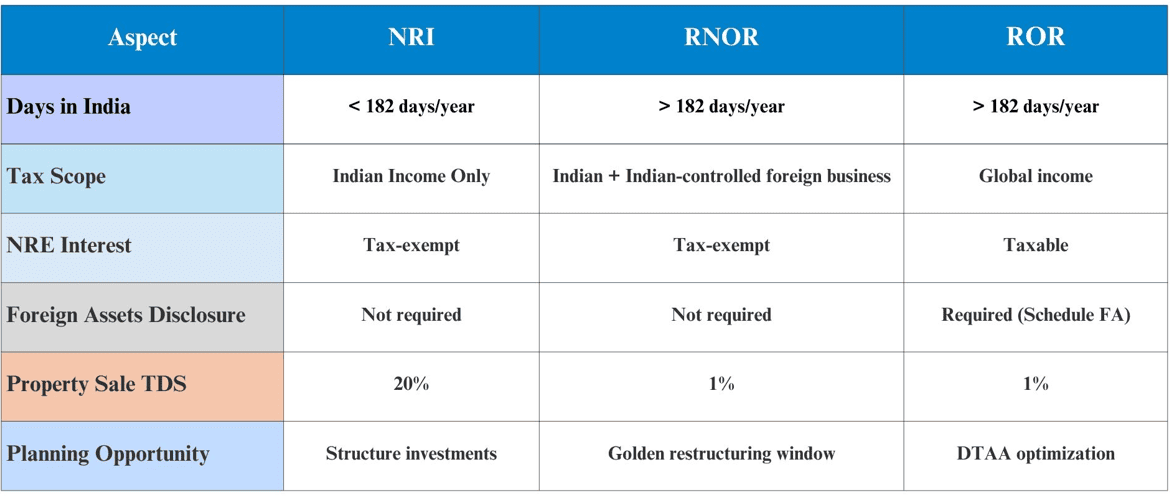

Your residency status directly impacts how India taxes your global income. Understanding the difference between Non-Resident Indian (NRI), Resident but Not Ordinarily Resident (RNOR), and Resident and Ordinarily Resident (ROR) classifications unlocks tax planning advantages most non-residents overlook.

These different statuses create tax planning windows that directly impact your wealth. By strategically timing investments and financial decisions around these transition periods, NRIs can save lakhs in taxation and access investment opportunities others miss entirely. Let’s find out more in this article.

Understanding NRI Residency Categories

To understand NRI taxation in India, you need to first understand the laws that classify individuals into three categories:

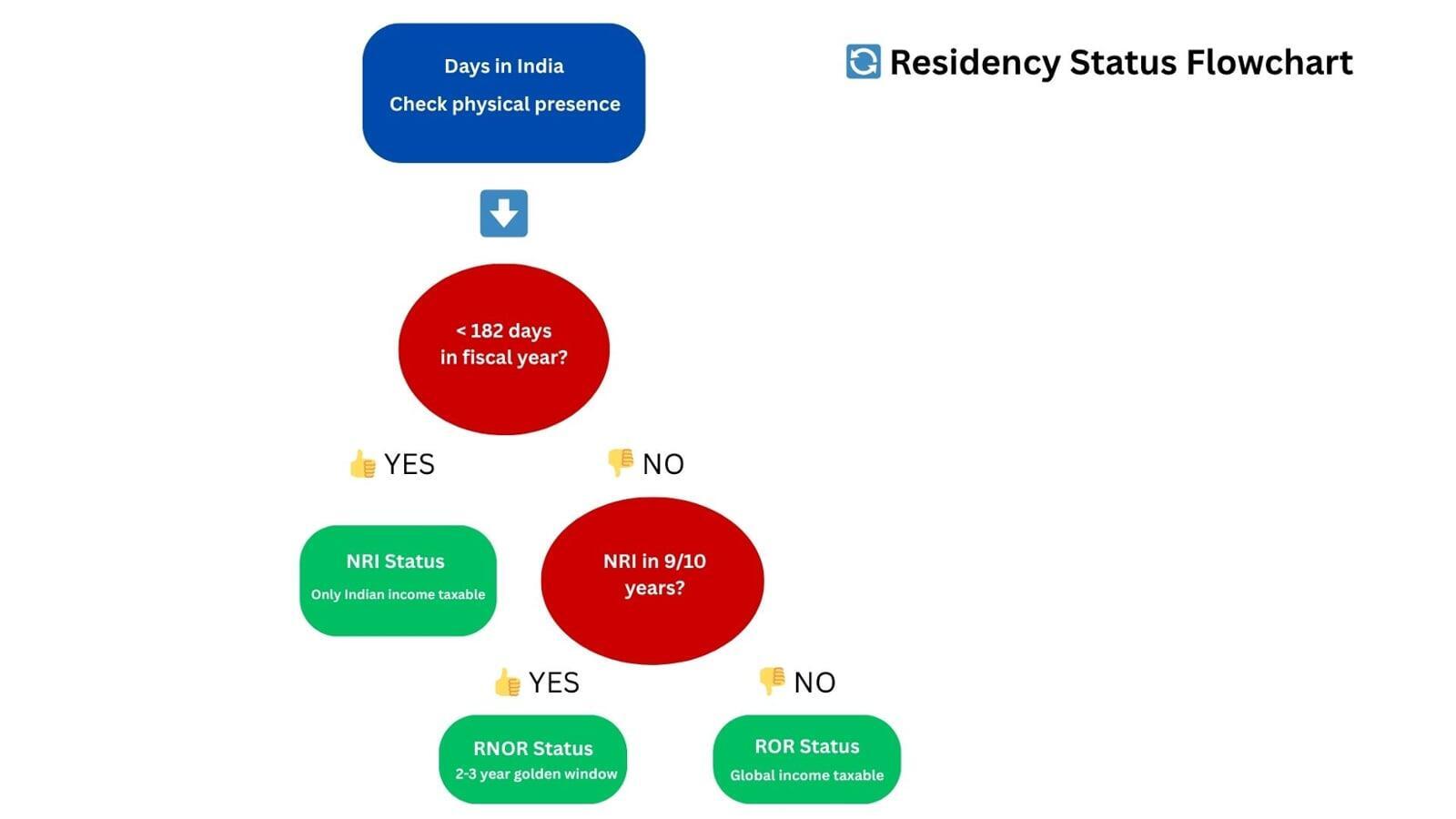

1. Non-Resident Indian (NRI): To qualify for Non-Resident Indian (NRI) status under Indian tax laws, your physical presence in India must be restricted to fewer than 182 days during a fiscal year. Alternatively, you may also qualify if you remain in India for under 60 days in the current financial year while simultaneously having spent less than 365 days in India over the previous four financial years combined.

For NRIs, only income earned or received in India is taxable in India. This includes rental income from Indian properties, interest from NRO accounts, capital gains from Indian investments, and income from business operations in India.

2. Resident but Not Ordinarily Resident (RNOR): This transitional status applies to individuals who were NRIs but are now spending more time in India. You qualify as RNOR if you were an NRI in 9 out of 10 preceding years or have stayed in India for 729 days or less in the last 7 years.

For RNORs, Indian income plus foreign income arising from a business or profession controlled from India becomes taxable.

3. Resident and Ordinarily Resident (ROR): After the RNOR period ends, you become a ROR, subject to taxation on global income. For RORs, global income from all sources worldwide becomes taxable in India.

The Transition Periods That Create Unique Tax Planning Windows

The transition from NRI to RNOR status, and subsequently to ROR status, creates distinct opportunities:

Pre-Return Planning Window: While still an NRI, you can structure investments, time income recognition, and organise repatriations optimally.

RNOR Window (2-3 years): During this period, most foreign income remains outside India’s tax net, creating a golden opportunity for financial restructuring.

Pre-ROR Planning: In the months before transitioning to ROR status, strategic decisions about foreign investments, retirement accounts, and asset holdings can significantly reduce future tax liabilities.

How NRIs May Accumulate Tax Liabilities?

NRIs often accumulate unexpected tax liabilities through:

Mistimed returns: Returning to India before properly planning the tax implications.

Poorly timed asset sales: Selling Indian assets while still an NRI, triggering higher TDS rates.

Unplanned retirement withdrawals: Making withdrawals from foreign retirement accounts after becoming a ROR without considering the tax implications.

Mismanagement of Employee Stock Ownership Plans (ESOPs): Having unvested stock options or restricted stock units vest after becoming a ROR, creating significant tax liabilities.

Failure to preserve special accounts: Not maintaining Non-Resident External (NRE) and Foreign Currency Non-Resident (FCNR) accounts properly during the transition period.

Improper documentation: Failing to complete necessary documentation for Double Taxation Avoidance Agreement (DTAA) benefits.

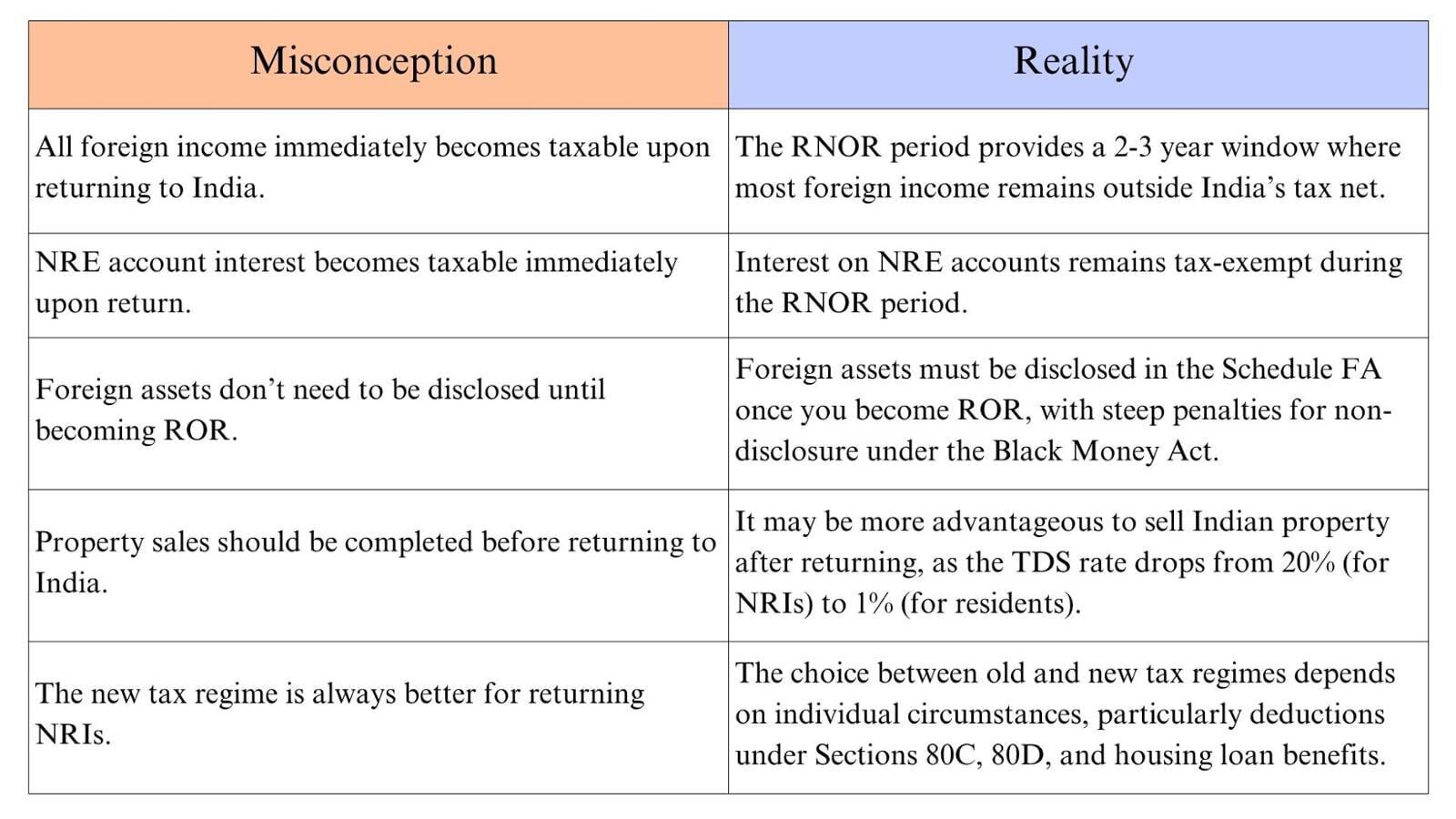

Common Misconceptions That Cost NRIs Lakhs

The Double Taxation Avoidance Agreements (DTAA) Advantage

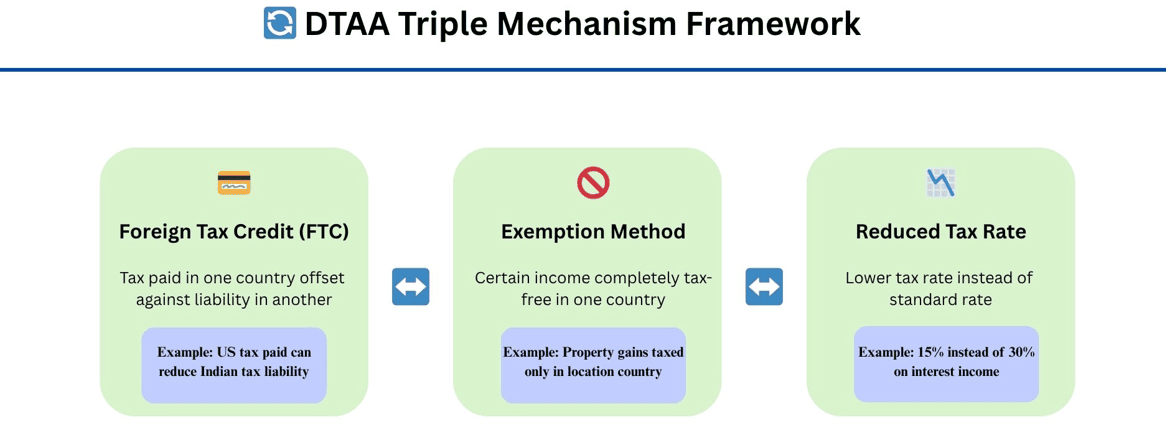

The Double Taxation Avoidance Agreement (DTAA) is a treaty signed between two countries to prevent the same income from being taxed twice. For NRIs, this means not having to pay taxes multiple times on the same income.

DTAAs operate through three primary mechanisms:

Foreign Tax Credit (FTC): Tax paid in one country can be offset against tax liability in another country.

Exemption Method: Certain types of income may be completely tax-free in one of the two countries based on the treaty.

Reduced Tax Rate: Instead of paying the standard tax rate, you may qualify for a lower tax rate under DTAA.

Country-Specific Opportunities

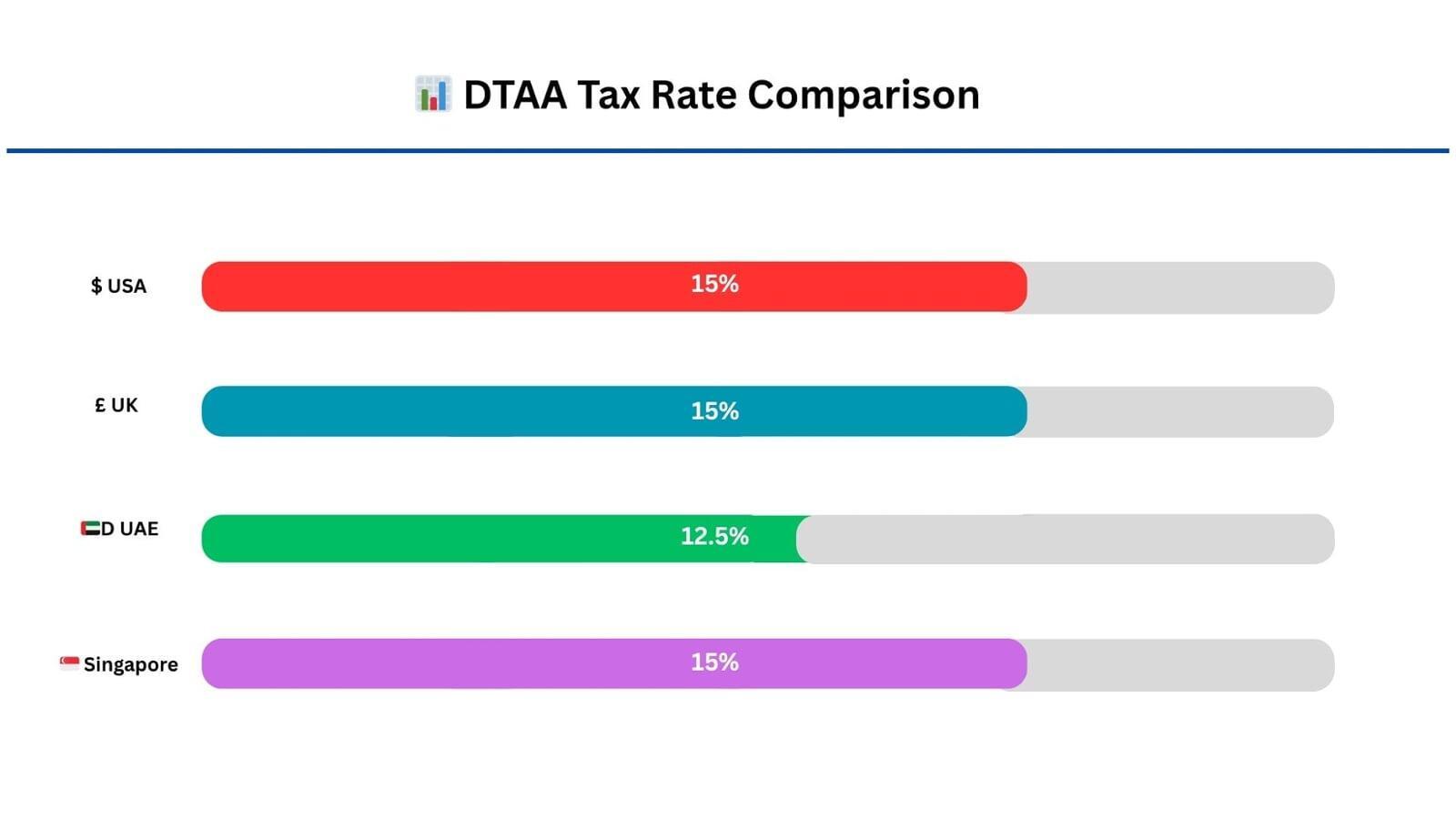

India has signed DTAAs with over 90 countries, creating specific advantages depending on your country of residence:

United States

Capital gains from property sales in India are taxed only in India.

US tax residents can claim a 15% concessional tax rate on interest income earned in India.

Dividends are typically taxed at a reduced rate, often between 5% and 15%.

Form 1040 in the US allows claiming Foreign Tax Credits for taxes paid in India.

United Kingdom

The DTAA with the UK sets a TDS rate of 15% for various income sources.

UK pension income may be taxable in the UK but can be offset against Indian tax liability.

Capital gains from the sale of shares are generally taxable only in the country of residence.

UAE

The India-UAE DTAA sets a TDS rate of 12.5%.

Capital gains from immovable property are taxed in the country where the property is located.

Income from employment is typically taxed in the country where the work is performed.

Given the UAE’s zero or low tax rates, careful planning can maximize tax efficiency.

Singapore

The DTAA with Singapore establishes a TDS rate of 15%.

Under recent amendments, capital gains from the alienation of shares may be taxed in both countries.

Dividends are subject to a reduced tax rate under the treaty.

Singapore’s territorial taxation system creates unique planning opportunities.

Additionally, a host country’s tax treaty with India could be your biggest tax-saving tool. However, many NRIs fail to utilise these advantages effectively.

Strategic Tax Planning for Different NRI Statuses

For Current NRIs with No Immediate Plans to Return

Optimise Indian Investments: Structure investments to minimise TDS and maximise DTAA benefits.

Consider NRE/FCNR Accounts: Utilise the tax advantages of these accounts for Indian investments.

Plan Property Investments: Structure property ownership and rental arrangements to optimise tax efficiency.

Document Foreign Tax Payments: Maintain clear records of taxes paid abroad to facilitate DTAA claims.

For NRIs Planning to Return to India

Time Your Return Strategically: Consider returning after 2nd October to maintain NRI status for that fiscal year.

Preserve NRE/FCNR Accounts: Maintain these accounts during the transition to benefit from their tax advantages.

Plan Property Sales: Consider whether selling property before or after return is more tax-efficient.

Manage Foreign Retirement Accounts: Develop a strategy for foreign retirement accounts before becoming an ROR.

Address ESOP/RSU Issues: Plan for the vesting of stock options, considering the tax implications of different residency statuses.

For Recently Returned NRIs in RNOR Status

Maximise the RNOR Window: Use this 2-3 year period to restructure investments and plan for the ROR transition.

Comply with Disclosure Requirements: Prepare for the disclosure of foreign assets in Schedule Foreign Assets (FA) upon becoming an ROR.

Plan Withdrawals from Foreign Accounts: Time withdrawals from foreign accounts to minimise tax liability.

📋 Residency Status Comparison Matrix

Conclusion

The intersection of NRI residency status and international tax treaties creates a complex but potentially rewarding space for tax planning and investment opportunities. Understanding the transition from NRI to RNOR to ROR status allows for strategic timing of investments, asset sales, and income recognition.

In this, DTAAs provide powerful tools for minimising tax liabilities across borders, but these advantages are often overlooked or misunderstood. By gaining a deeper understanding of your specific residency status and the applicable tax treaties, you can create significant tax efficiencies and investment advantages.