Is your investment building the future you want to see? This question is becoming increasingly common among investors. This is the concept of sustainable investing. In simple words, sustainability means that you use the existing resources to meet your needs, but in such a way that they are not compromised for future generations.

For example, you use a car to meet your commute needs, but turn it off during traffic signals so it saves i) fossil fuel and ii) also contributes to climate change for future generations.

While this is the normal concept of sustainability, nowadays, companies are also considering these measures in their operations and reporting standards. However, what does this mean for your portfolio? And is it just another investing fad, or something more fundamental?

In this article, let’s explore how you can align your investments with your values. Investing isn’t just about returns anymore, it’s about the kind of future you are helping to build.

Understanding Sustainable Investing

At its core, sustainable responsible investing (SRI) is about investing your capital to work on a dual mission:

But that simple definition barely scratches the surface.

The evolution has been remarkable. Just five years ago, sustainable investing was often dismissed as a niche approach that sacrificed returns for feel-good factors.

But how exactly has SRI transformed over the years? And why are investors increasingly drawn to it?

Evolution of Sustainable Investing

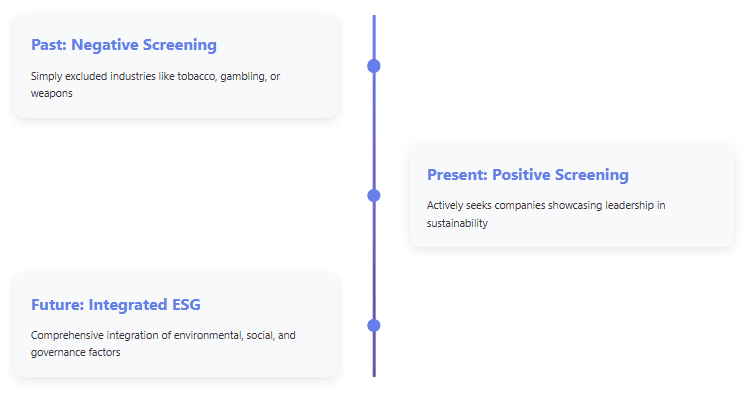

Socially responsible investing initially applied ethical or values-based screens to investment decisions. The original "negative screening" simply excluded industries like tobacco, gambling, or weapons. It still exists, but today's SRI goes much deeper. Positive screening actively seeks companies that showcase leadership in sustainability.

Also, in India, new regulations and government support, along with awareness among people, are contributing to the popularity of sustainable investing.

For example, SEBI’s Business Responsibility and Sustainability Reporting (BRSR) framework, which was implemented in 2023, represents a watershed moment for sustainable investing. It makes it mandatory for the top 1,000 listed companies to standardise ESG disclosures and makes comparison much easier for investors.

How to Include Sustainability in Your Portfolio?

Here are some ways that can help you include sustainability in your existing portfolio.

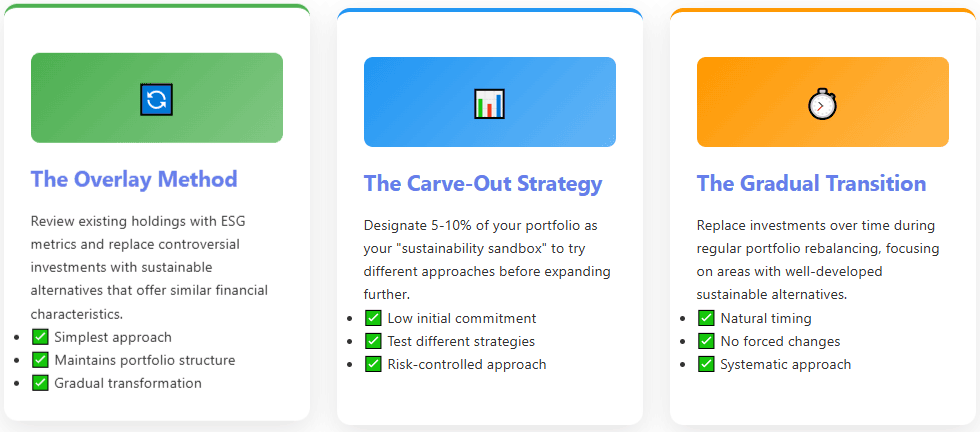

The Overlay Method

The overlay method is the simplest way to start your sustainable investing journey. To implement this approach, first review your existing holdings with ESG metrics. Look for companies involved in controversial activities like fossil fuel extraction or those with poor labour practices. These become your first candidates for replacement with more sustainable alternatives that offer similar financial characteristics.

For example, if you own a traditional energy company with poor environmental ratings, you might replace it with one that has substantial renewable energy investments while maintaining similar financial fundamentals. It is possible that you may not find the exact fundamentals between two companies; in such a case, you can consider the future potential and, based on that, make your decision.

The Carve-Out Strategy

With the carve-out strategy, you designate a specific portion of your portfolio for sustainable investments. To get started, allocate about 5-10% of your portfolio to sustainable options. This becomes your sustainability sandbox, a place to try different approaches before expanding further.

For instance, you might carve out 5%-7% of your equity allocation for a dedicated ESG fund, while keeping the rest of your portfolio unchanged. This way, you can keep your overall portfolio and still include sustainable investing as a part of your broader investment approach.

The Gradual Transition

The gradual transition allows you to replace investments over time during your regular portfolio rebalancing. To determine where to start, focus on areas with well-developed sustainable alternatives. Large-cap ESG equity funds, green bonds, and renewable energy sectors typically offer the most mature options with competitive performance.

For example, when it's time to rebalance your large-cap exposure, you might switch from a traditional index fund to one tracking the Nifty100 ESG index instead.

The 70-20-10 Framework

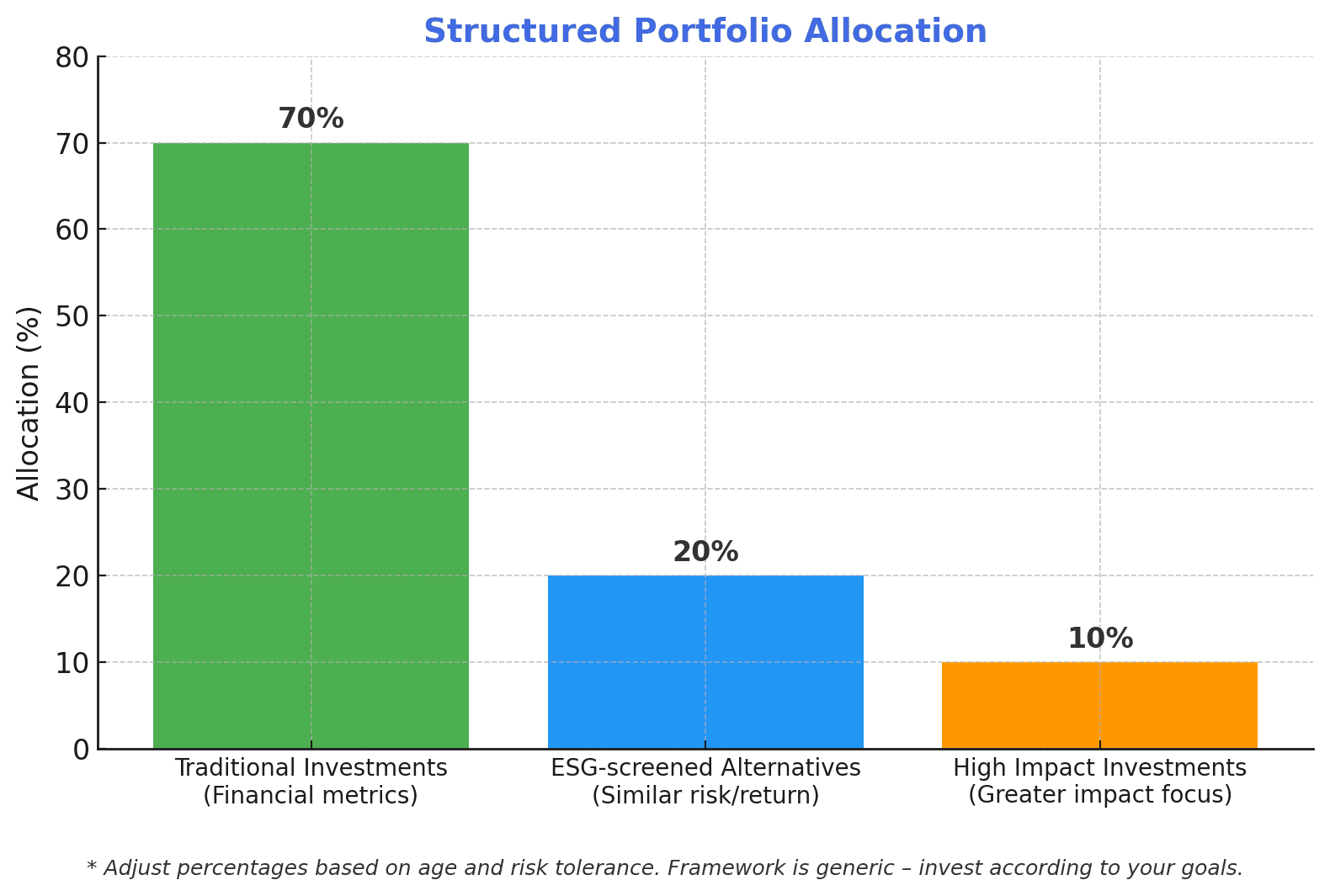

For a structured approach, you can consider the 70-20-10 framework for your portfolio. This means you allocate 70% to traditional investments based on financial metrics, 20% to ESG-screened alternatives with similar risk/return profiles, and 10% to high-impact investments where you might accept slightly lower returns for greater positive impact.

Adjust these percentages based on your age and risk tolerance. In your 30s, you might increase your high-impact allocation to 20-25%, while in your 50s, you might reduce it to 5-10% as capital preservation becomes more important. However, note that this framework is generic, and you should invest as per your overall goals and risk appetite.

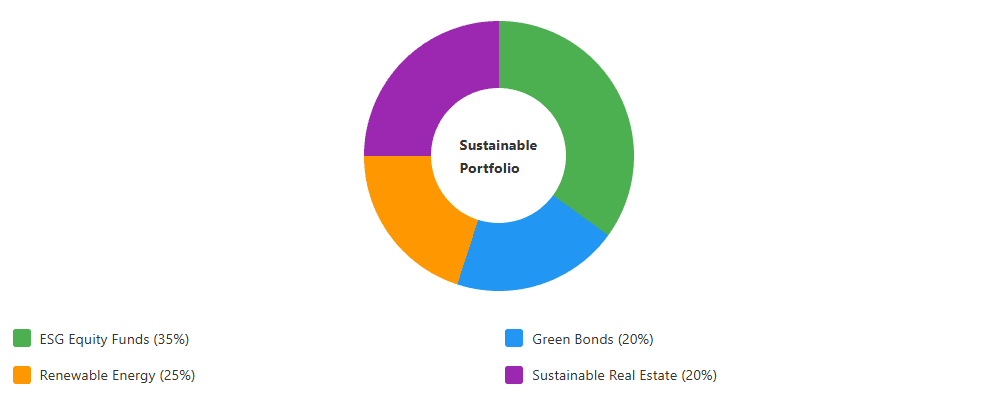

Diversification of Sustainable Investment

Diversification is not limited to traditional investing. Even in your 5%-10% sustainable portfolio (of the overall traditional portfolio), you can implement this principle. For example, you can diversify your sustainable portfolio by including green bonds alongside equity investments. These fixed-income instruments typically yield slightly less than conventional bonds but offer environmental benefits.

For example, you could allocate a portion of your debt portfolio to green bonds. This helps you maintain your income stream while supporting environmental projects.

Remember, including sustainability in your portfolio doesn't require dramatic changes all at once. Even small adjustments can make a meaningful difference over time, often while increasing your portfolio's resilience alongside its positive impact.

Check for Greenwashing

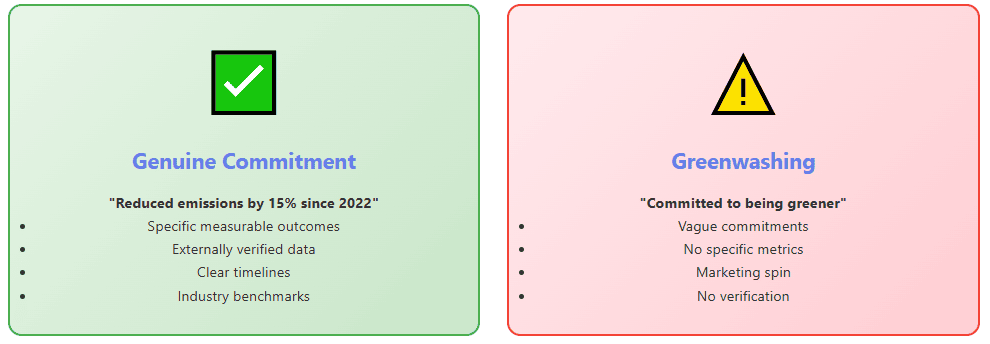

Greenwashing is when companies or funds exaggerate their environmental credentials to appear more sustainable than they really are. It is like a marketing spin without substance.

To spot greenwashing in your investments, look for specific, measurable outcomes rather than vague commitments. For example, a company serious about sustainability reports exact figures, "reduced emissions by 15% since 2022", and not just "committed to being greener."

Why does this matter? Because connecting your investments to ground realities provides both personal satisfaction and a check against greenwashing.

Ask these questions about your sustainable investments:

What specific environmental or social outcomes are being measured?

How do these metrics compare to industry averages?

Is the data externally verified by independent auditors?

Do the impacts address issues relevant to India's development challenges?

The answers help ensure your investments are creating the change you want to see.

Conclusion

Investing with values isn’t just about feeling good, it’s about recognising unique risks and opportunities.

Companies addressing sustainability challenges proactively may be better positioned for long-term success in a changing economy.

By starting with what matters to you, then exploring how to express those values through your investments, you can create a portfolio with personal meaning. However, always consider your risk tolerance level before making any investment decision.