India remains one of the world’s largest gold consumers, with a predicted annual demand of 700-800 tonnes in 2025. The gold investment in India increased by 29% in 2024, reaching 239.4 tonnes. This is the highest since 2013. Gold is also often seen as a safe haven, especially during times of market volatility, which also leads to its popularity as an investment option. If you are wondering why, you have come to the right place. In this article, we will cover the history of gold in India and how it helps investors in times of market volatility.

The History of Gold in India

The story of gold in India is as old as civilization itself, with a rich history that spans thousands of years. Gold was a key commodity traded along the ancient Silk Road route connecting the East and West. Indian gold, known for its purity, was highly sought after by merchants from China, Persia, and Rome. It was often used as a medium of exchange for spices, which were as valuable as gold in ancient times. This trade significantly contributed to India's wealth and reputation as the "Golden Bird." For centuries, Indians have viewed gold as a reliable store of wealth. For instance, the opulence of Mughal courts was often measured by their gold reserves. The famous Peacock Throne of Shah Jahan was adorned with an estimated 500 kg of gold and precious stones.During British rule, India's currency was tied to the gold standard, cementing gold's importance in the economy. The export of Indian gold to Britain during colonial rule became a significant economic issue, often referred to as the "drain of wealth."

Today, gold is not just bought in the jewellery or bar form but also via modern investment instruments. For example, the introduction of Gold Exchange Traded Funds in 2007 provided a new avenue for gold investment. Later in 2015, Sovereign Gold Bonds (SGBs) were launched by the government and are denominated in grams of gold, offering an alternative to physical gold ownership.Indian families value not just as an asset but also as “Punjee for tough times.” They often invest surplus income in gold jewellery, which could be easily liquidated in times of need. During festivals like Diwali and Akshaya Tritiya, buying gold is considered auspicious.

Why is Gold Seen As a Safe Haven during Market Volatility?

Gold has long been considered a safe haven asset during times of market volatility. Here is why:

1. Store of Value

Gold has been used as a form of currency and store of value for thousands of years. Unlike paper currencies or digital assets, gold is a tangible commodity with inherent value.Its durability, divisibility, and inability to be counterfeited contribute to its reliability as a store of wealth. Different types of gold purity have different considerations:

22 Karat Gold (91.7% pure): Preferred for jewellery

24 Karat Gold (99.9% pure): Ideal for investment

- Hallmark certification ensures quality and builds trust

2. Hedge Against Inflation

Gold's effectiveness as an inflation hedge is rooted in its inverse relationship with the U.S. dollar. As inflation rises and erodes the purchasing power of the dollar, the price of gold typically increases.For example, during the high inflation period of the 1970s, gold prices soared from $35 per ounce to over $650. In the aftermath of the 2008 financial crisis, quantitative easing policies led to concerns about inflation, contributing to gold's price rise from around $800 to over $1825 per ounce by 2011. During COVID-19, it made a high of $2000 in 2020. At present, the gold price is at an all-time high of over $3000+.This makes it an attractive option for investors looking to protect their wealth from the eroding effects of inflation.

3. Non-Correlation with Other Assets

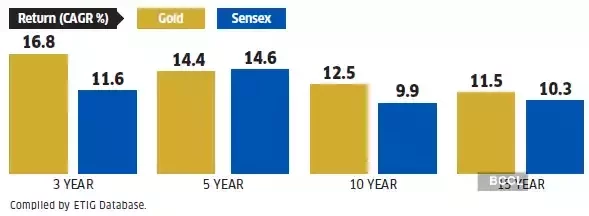

Gold typically has a low or negative correlation with other major asset classes such as stocks and bonds. This means that when these markets experience volatility or decline, gold prices often move in the opposite direction or remain stable.For instance, in the 2008 financial crisis, the BSE Sensex fell by 38%, and the gold prices gave a return of 24.58%. This negative correlation makes gold an effective portfolio diversifier, potentially reducing overall portfolio risk. This characteristic makes gold an effective diversification tool in investment portfolios.

4. Geopolitical Stability

In times of geopolitical tension or conflict, investors often turn to gold as a safe haven. Gold is not tied to any specific government or economy, making it less vulnerable to political instability or economic sanctions that can affect other assets or currencies.The Reserve Bank of India (RBI) has been actively increasing its gold reserves, reflecting a global trend among central banks to diversify away from the U.S. dollar and hedge against geopolitical risks.In January 2025, the RBI added 2.8 tonnes of gold to its reserves, bringing its total gold holdings to a new high of 879 tonnes. This continued accumulation demonstrates India's strategic approach to strengthening its economic resilience in the face of global uncertainties.The share of gold in India's forex reserves has steadily climbed from 7.7% in January 2024 to 11.31% by early February 2025, indicating a significant shift in the country's reserve management strategy.

5. Gold’s Consistent Performance

Gold's historical performance during crises continues to reinforce its status as a safe-haven asset. In early 2025, gold prices in India reached new record highs of Rs. 90,000+. This is significantly higher than the gold prices in 2010 or 2020, which stood at Rs. 18,000+ and Rs. 48,000+, respectively.This is also true for investments in Gold ETFs with an inflow of ₹37.5 billion (approximately US$435 million) in January 2025, significantly higher than the average monthly inflows over the previous year.

The psychological aspect of gold as a safe haven is deeply ingrained in investor behaviour. This is partly due to gold's tangible nature and its historical significance. During times of crisis, the "flight to quality" phenomenon often sees investors moving their money from perceived high-risk assets to lower-risk ones, with gold being a prime beneficiary.This behaviour is often self-reinforcing, as increased demand drives up gold prices, attracting more investors and media attention, which in turn reinforces the perception of gold as a safe haven.

How to Invest in Gold in India?

Gold Mutual Funds

Gold Mutual Funds offer an alternative approach to investing in gold, distinct from ETFs. These funds are actively managed investment vehicles that allocate their assets across various gold-related instruments, including Gold ETFs, gold mining stocks, and derivatives. This approach provides investors with broader exposure to the gold market and the potential for additional returns through active management.Unlike Gold ETFs, Gold Mutual Funds do not require a Demat account for investment, making them more accessible to a wider range of investors. They also offer the flexibility of Systematic Investment Plans (SIPs), allowing investors to start with amounts as low as ₹500.The active management of Gold Mutual Funds results in slightly higher expense ratios, typically ranging from 1% to 2%. However, this professional management can potentially lead to competitive returns.

Digital Gold

Digital Gold allows investors to buy gold electronically and store it digitally in secure vaults. Digital Gold is directly linked to physical gold of 99.9% purity, ensuring that investors have a claim on high-quality gold without the need for physical possession.Investors can purchase gold in small denominations, with some platforms allowing investments starting from as little as ₹1. This flexibility makes gold investment accessible to a broader range of individuals, particularly younger investors. In fact, over 75% of investors under 35 now choose digital platforms for their gold investments.However, it's important to note that Digital Gold platforms are currently unregulated in India, which may pose some risks in case of fraud or platform failure. Additionally, Digital Gold investments are subject to a 3% upfront GST charge and follow the same tax structure as physical gold. Any interest earned from leasing gold to vendors is taxed according to the investor's income slab rates.

Sovereign Gold Bonds (SGBs)

Sovereign Gold Bonds (SGBs) are a gold investment option introduced by the Reserve Bank of India, offering investors a way to hold gold in paper or dematerialized form. These government-backed securities provide investors with returns linked to gold prices while also offering a fixed interest rate, combining the potential for capital appreciation with regular income. They have a lock-in period of 5 years and a maturity period of 8 years.SGBs pay a fixed interest rate of 2.50% per annum on the nominal value, credited semi-annually to the investor's account. The minimum investment in SGBs is 1 gram of gold, with a maximum limit of 4 kg for individuals and Hindu Undivided Families (HUFs), and 20 kg for trusts and similar entities per financial year.Capital gains from SGBs are exempt from tax if held until maturity. If sold in the secondary market before maturity, long-term capital gains are taxable with the benefit of indexation, which can significantly reduce the tax burden.

Conclusion

In times of market volatility or downturn, gold acts as an insurance policy, bailing out investors with its diversification ability. There are various ways in which investors can include gold in their portfolio as discussed in this article. However, gold investments should be done as per the specific financial goals and risk appetite of investors.