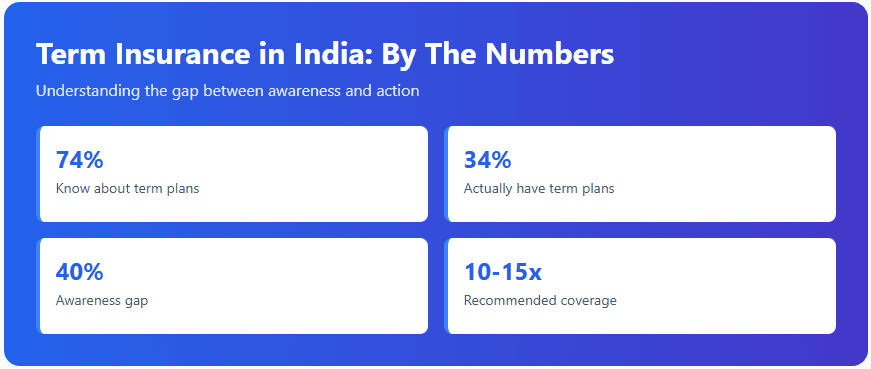

Term insurance is the purest form of life insurance. It offers affordable protection that provides a substantial death benefit to your family if you’re no longer around. However, as per a recent survey, while 74% of people know about the term plan, only 34% of them actually have a term plan. This number showcases the lack of understanding and awareness among people of the importance of a term plan.

With adequate term insurance, you can ensure your family maintains their lifestyle, pays off debts, and fulfils long-term goals even in your absence. To help you, in this article, we will cover how to select the best term plan in 2025 for your specific needs.

What is Term Insurance?

In term insurance, you pay premiums for a specific period (the term). If you pass away during this term, your nominees receive the sum assured. If you outlive the policy term, you get nothing back.

This structure keeps premiums affordable, often 5-10 times cheaper than traditional endowment or whole life policies for the same coverage amount.

Here are some of the types of term insurance:

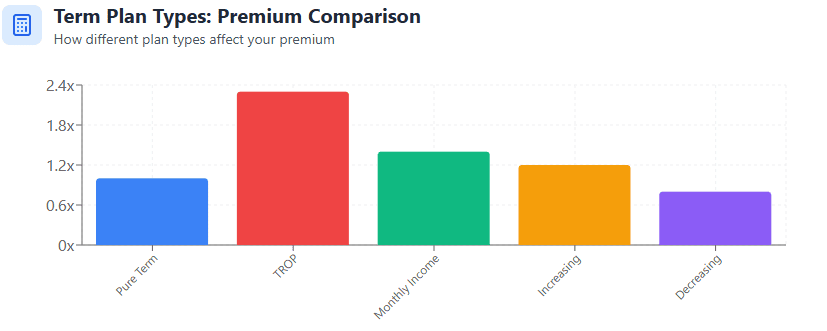

Pure Term Plans: The most basic and affordable option. Provides a death benefit during the term with no return of premium.

Term Return of Premium (TROP): Returns all paid premiums if you survive the policy term. Premiums are typically 2-2.5 times higher than pure term plans.

Term Plan with Monthly Income: Instead of a lump sum, pays your nominees a monthly income for 10-15 years after your death, sometimes with an additional lump sum component.

Increasing Term Plans: The sum assured increases over time (usually by 5-10% annually) to counter inflation. Premiums are slightly higher than regular term plans.

Decreasing Term Plans: Sum assured decreases over time, usually aligned with decreasing loan balances. It is commonly used for mortgage protection.

For most families, pure term plans offer the most efficient protection. Also, you get tax benefits under Section 80C, with term plan premiums up to ₹1.5 lakh annually qualifying for tax deduction. Death benefits remain tax-free under Section 10(10D).

What is the Right Coverage Amount for a Term Plan?

The most critical decision in term insurance is choosing adequate coverage. Too little, and your family remains vulnerable. Too much, and you waste money on unnecessary premiums.

Here are two methods to help you find the right coverage for a term insurance policy.

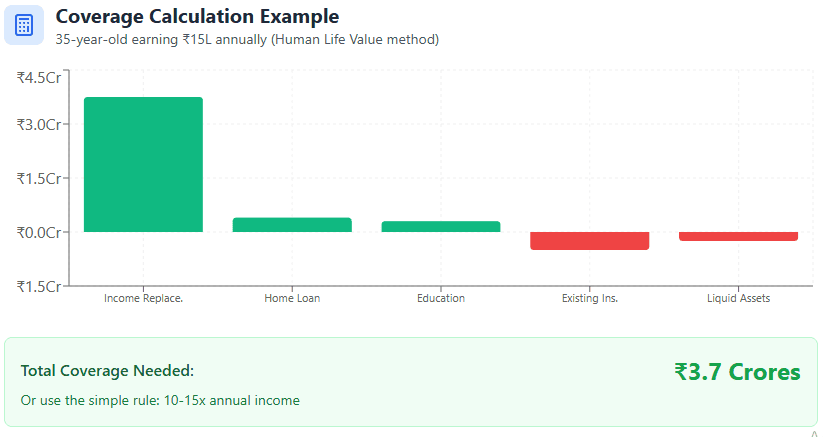

1. Human Life Value method

Here is the formula for Human Life Value (HLV) :

HLV = Coverage needed = [Annual income × (1 + inflation rate) × years until retirement] + Liabilities - Existing insurance - Liquid assets

Let’s understand with an example.

Rahul, 35, earns ₹15 lakh annually, expects to work until 60, and assumes 6% inflation.

Income replacement: ₹15 lakh × (1 + 6%) × 25 years = ₹3.75 crore

Outstanding home loan: ₹40 lakh

Children’s education fund needed: ₹30 lakh

Existing insurance: ₹50 lakh

Liquid investments: ₹25 lakh

Ideal coverage = ₹3.75 crore + ₹40 lakh + ₹30 lakh - ₹50 lakh - ₹25 lakh = ₹3.7 crore

Many experts suggest an even simpler rule of thumb: 10-15 times your annual income as the minimum coverage amount.

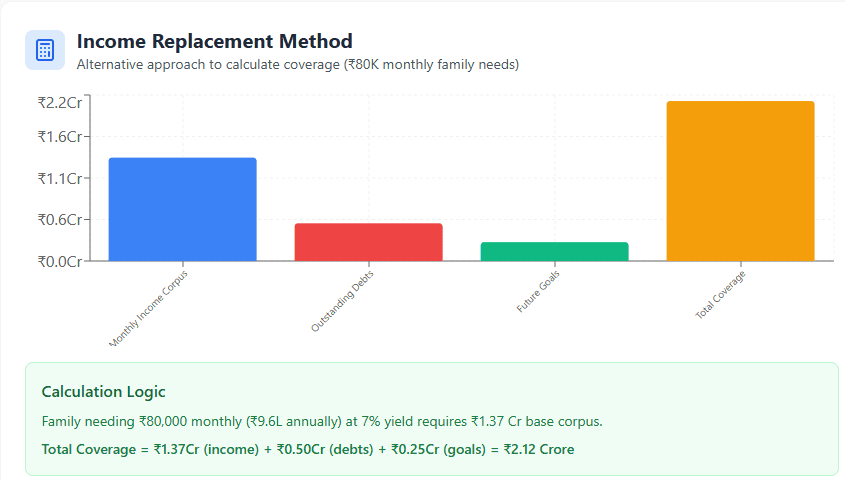

2. Income Replacement Method

Another approach is to calculate how much investment would generate enough monthly income to support your family:

If your family needs ₹80,000 monthly (₹9.6 lakh annually) and safe investments yield 7% annually, they would need a corpus of: ₹9.6 lakh ÷ 7% = ₹1.37 crore.

Add outstanding liabilities and future goals to this amount.

Your coverage needs evolve with your life stage. A young parent with dependent children needs significantly more coverage than someone approaching retirement with grown children and minimal liabilities.

How to Select the Best Term Plan for Yourself?

Now that you know how much life insurance coverage you need, let’s see how to buy the best life insurance in 2025.

1. Select the Policy Term

Choosing the right policy term is simple. You will need a policy until your retirement age or until your youngest dependent becomes financially independent.

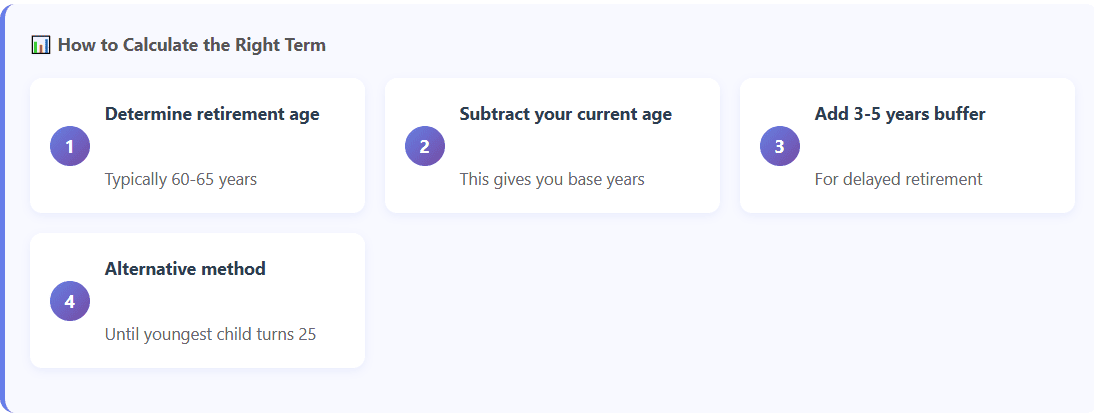

To calculate the right term:

Determine your intended retirement age (typically 60-65)

Subtract your current age

Add 3-5 years as a buffer for delayed retirement

Alternatively, calculate until your youngest child turns 25

For most working professionals in their 30s, a term plan of 25-30 years makes sense.

2. Decide on Premium Payment Options

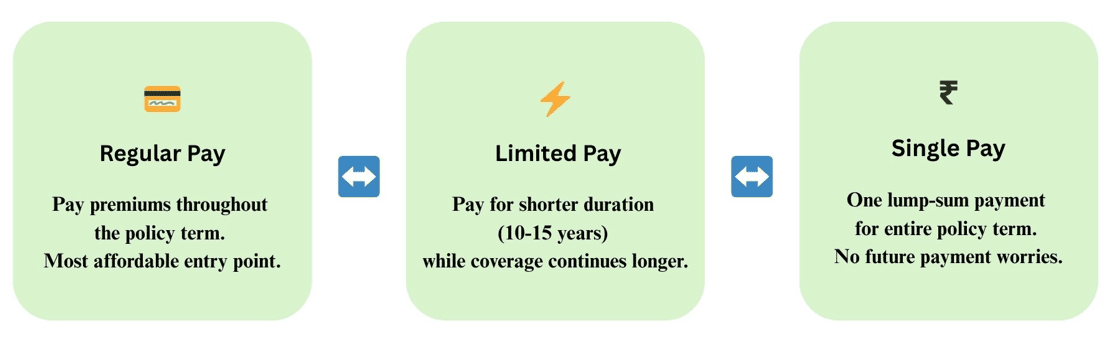

Premium payment structures offer flexibility to match your financial situation:

: Pay premiums throughout the policy term

Limited pay: Pay for a shorter duration (e.g., 10 or 15 years) while coverage continues longer

Single pay: One lump-sum payment for the entire policy term

For most people, regular pay offers the most affordable entry point. But if you have good cash flow now and want to eliminate the risk of missing future payments, limited pay options are worth considering.

3. Choose The Right Add-ons and Riders

Usually, base term policies cover death by any cause (except exclusions like suicide within the first year). However, riders add extra protection for specific situations.

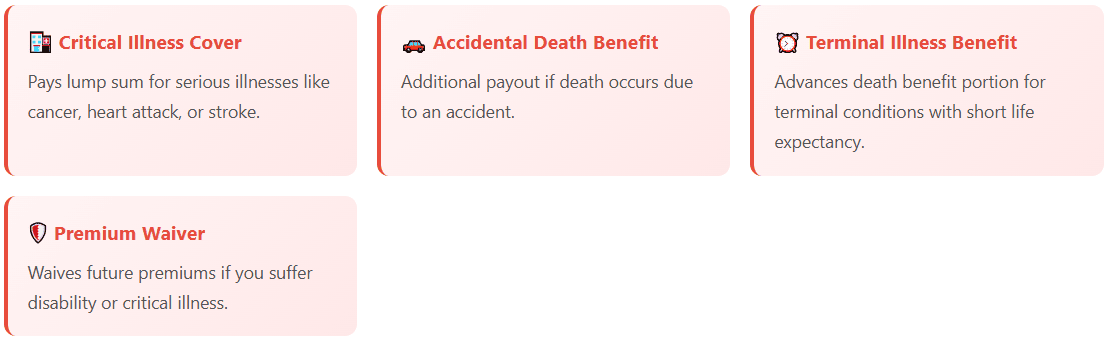

The most valuable riders include:

Critical Illness Cover: Pays a lump sum if you’re diagnosed with covered serious illnesses like cancer, heart attack, or stroke.

Accidental Death Benefit: Provides additional payout if death occurs due to an accident.

Terminal Illness Benefit: Advances a portion of the death benefit if you’re diagnosed with a terminal condition with a short life expectancy.

Premium Waiver: Waives future premiums if you suffer disability or critical illness, ensuring your policy continues even when you can’t pay.

Not all riders offer equal value, and they also increase the premium amount. Instead of loading your term policy with numerous riders, sometimes purchasing separate specialised policies (like critical illness insurance) offers more comprehensive protection at better rates.

4. Check Claims Settlement Ratio

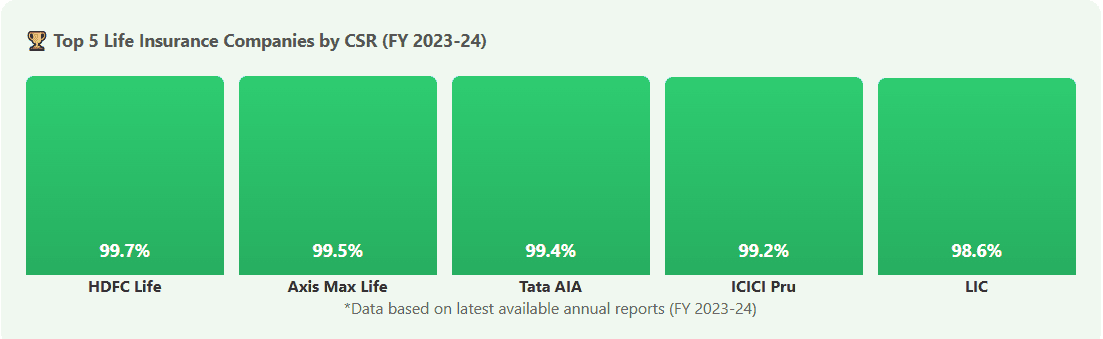

The claims settlement ratio (CSR) indicates the percentage of death claims paid by an insurer. While important, this number doesn’t tell the whole story.

Source: PolicyBazaar.com

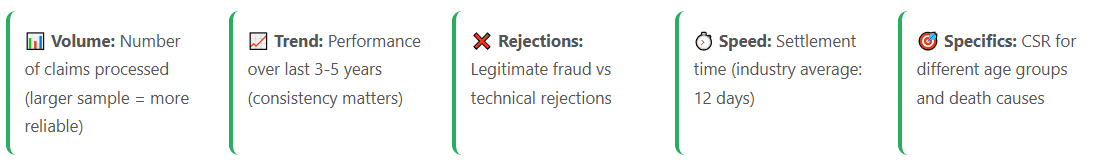

You may have seen CSR across insurers. Some may have 98% while some have 85%. However, along with this number, you also need to understand:

Number of claims processed (larger sample is more reliable)

Trend over the last 3-5 years (consistent performance is better than fluctuating numbers)

Rejection reasons (legitimate fraud cases vs. technical rejections)

Time taken for settlement (the industry average is 12 days for non-investigated claims)

Claim settlement ratio for specific age groups and death causes (some insurers may have higher rejections for certain categories)

The best insurers maintain high settlement ratios while processing large claim volumes over several years.

5. Compare Premiums

With dozens of insurers in India to choose from, you need to compare term plans. You should not be stuck on the price point. For this, you need to compare policies with:

Same sum assured and term

Identical riders and benefits

Similar payout options (lump-sum vs. monthly income)

Equivalent exclusions and conditions

Buying a term plan online typically offers lower premiums than offline channels due to reduced distribution costs.

6. Make the Final Decision

Consider the following factors while making your final decision.

Check for | What to Check? |

Evaluating Insurer Stability | - At least 10+ years in India - Strong solvency ratio (above 1.5) - Positive customer reviews about claims - Simple claim process with minimal documentation - Strong parent company or reinsurance backing |

Policy Documentation & Exemptions | - Suicide exclusion period: Typically 12 months - Lifestyle exclusions: Hazardous activities, overseas travel restrictions - Coverage limitations: Limited international coverage in some policies - Claim filing deadlines: Ranges from 30 days to 3 months - Premium grace period: Usually 15–30 days - Definition of "death by accident" varies significantly between insurers |

Always read your policy carefully before accepting it, such as your name, address, medical conditions, etc. In case of discrepancies, contact the insurer and correct the errors to avoid them being a reason for claim rejection in the future.

Once you buy a term plan, store it securely and let your family members know about it. Also, don’t forget to add a nominee to avoid complications later.

Conclusion

Term insurance isn’t complicated, but getting it right makes all the difference when your family needs it most. With term insurance premiums increasing with age, every year of delay means higher lifetime costs. You will pay less for a term plan at the age of 30 than at 35. So, start early and make sure the term plan coverage is adequate for your loved ones.