Over the years, Alternative Investment Funds, also known as AIFs, have become a nuanced investment option for investors who wish to invest beyond traditional market options. These investment funds invest in unique asset classes and investment strategies, which differentiate them from conventional investment instruments.

However, if you wish to invest in AIFs, you need to meet specific eligibility criteria. One of the unofficial or unspoken criteria is your age, which determines whether AIFs are suitable for your portfolio.

Let’s find out more about this in this article.

What Are Alternative Investment Funds?

Alternative Investment Funds are investment instruments where investors pour their funds as per a defined investment strategy. These funds operate under the regulatory oversight of SEBI through the SEBI (Alternative Investment Funds) Regulations, 2012. These funds abide by the rules set by SEBI under their 2012 AIF Regulations, which help protect investors while allowing fund managers some flexibility in how they invest.

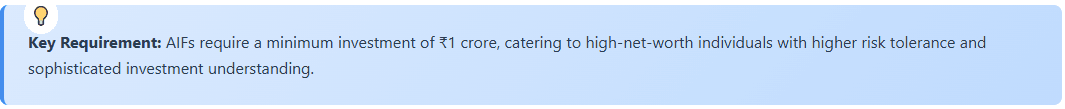

Unlike mutual funds, which are available to retail investors with minimal investment thresholds such as Rs. 500 for Systematic Investment Plans (SIPs),

AIFs cater to investors who can commit a minimum of ₹1 crore and possess a higher risk tolerance.

They can be created as companies, trusts, body corporates, or limited liability partnerships (LLPs). The fundamental purpose of AIFs is to invest in assets and strategies that fall outside the conventional investment spectrum of stocks, bonds, and fixed deposits.

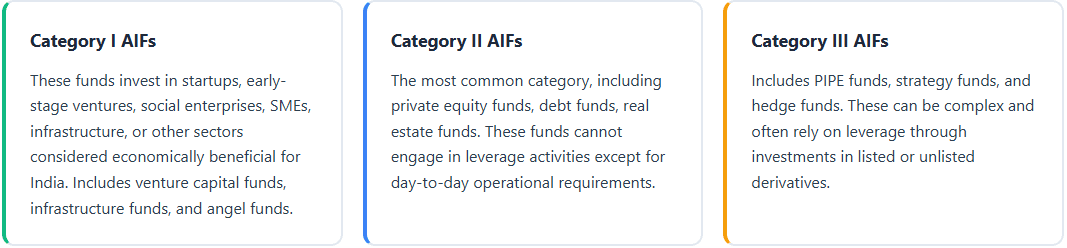

SEBI has classified AIFs into three distinct categories based on their investment strategies and regulatory implications:

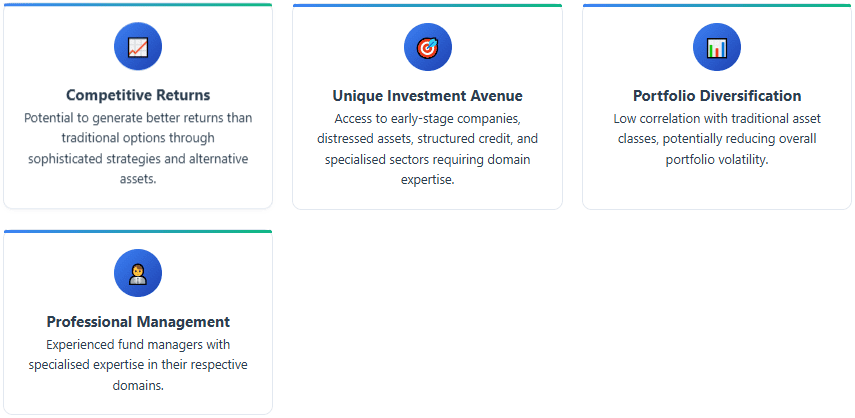

Why Do Alternate Investment Funds Appeal to Investors?

Here are the main reasons why investors are considering AIFs.

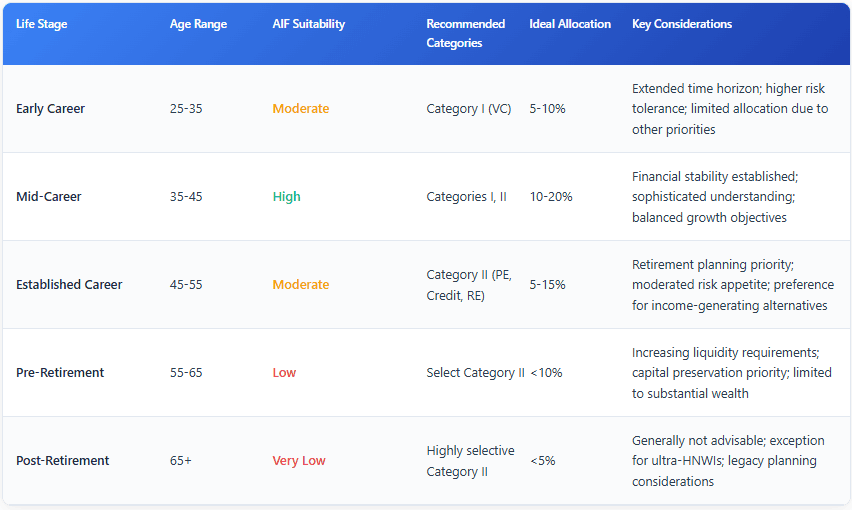

Optimal Age for AIF Investments: Life Stage Analysis

The suitability of whether you should consider investing in AIFs depends on your life stage, financial objectives, and risk tolerance.

(Note: The suggested funds are for example purposes only and not investment advice. Conduct your own research before investing.)

Risk Appetite Considerations

Regardless of age, risk profile should also be considered:

Conservative Investors: Generally unsuited for AIFs regardless of age

Moderate Risk Investors: Limited allocation to Category II AIFs, decreasing with age

Aggressive Risk Investors: Can consider broader AIF exposure in early/mid-career stages

Ultra-Aggressive Risk Investors: May maintain high allocations throughout life stages, though gradually shifting to more conservative strategies

However, individual circumstances should always supersede age-based generalisations when determining AIF investment suitability.

Foreign nationals wishing to invest in Indian AIFs must comply with the Foreign Exchange Management Act (FEMA) regulations and may face additional eligibility requirements depending on their country of residence and the specific AIF structure.

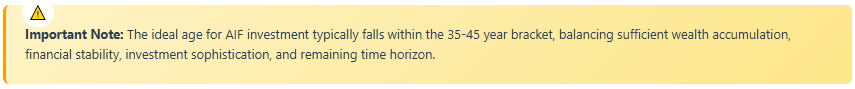

Drawbacks of Investing in AIFs

High Minimum Investment

The ₹1 crore minimum investment requirement creates a significant barrier for most retail investors, limiting access to a select demographic of high-net-worth individuals.

Limited Liquidity

Most AIFs, particularly Categories I and II, have extended lock-in periods ranging from 3 years to more, based on where the fund invests. This can restrict investors' ability to access funds during this period.

Complex Fee Structures

AIFs typically charge multiple fees, including management fees (1-2% annually), performance fees, typically 20% of profits above a hurdle rate, and other expenses that can impact overall returns.

Regulatory Changes

The regulatory landscape governing AIFs can change, which can potentially affect existing fund structures and investment strategies.

Limited Transparency

Compared to mutual funds and listed securities, AIFs have relatively lower disclosure requirements, which may limit investor visibility into fund operations.

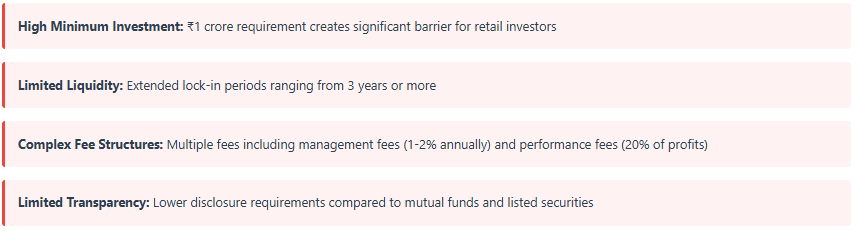

A Comparison with Other Investment Options

Conclusion

Alternative Investment Funds offer access to unique opportunities beyond traditional market options. However, the substantial financial threshold of ₹1 crore effectively restricts AIF investments to high-net-worth individuals.

Investors should conduct thorough due diligence on fund managers, investment strategies, and fee arrangements before committing capital. Additionally, investors should consider AIFs as complementary components within a well-diversified portfolio rather than standalone investment vehicles.