Taxation can be complex, but understanding how to optimise your tax liability is important if you wish to retain more of your hard-earned income.

In this article, we will cover how, as a salaried employee, you can save taxes in India. Whether you're new to the workforce or an experienced professional, this blog offers valuable insights for everyone.

Understanding Your Tax Liability

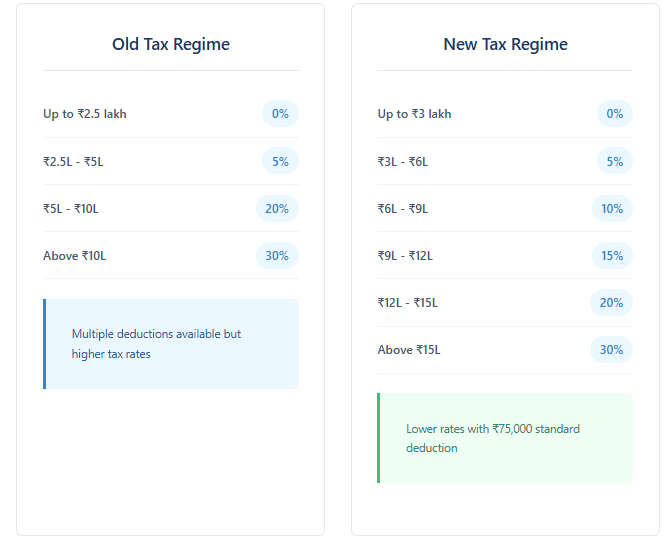

Before starting on how you can save tax as an employee, you need to understand the two tax regimes currently in place.

It's worth noting that the new regime offers a standard deduction of ₹75,000 for salaried individuals. However, the good news is that from this financial year, under the new regime, the taxable income limit has been increased to ₹12 lakh and for employees, it is ₹12.75 lakh.

Coming back to this year, you need to select the appropriate tax regime depending on your financial situation:

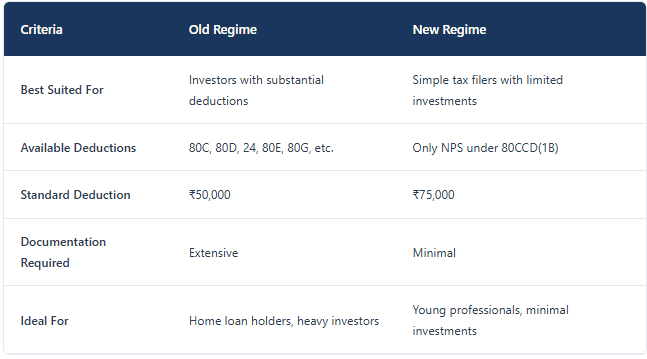

Which Regime Should You Choose?

It's important to note that there's no universal solution. The choice depends on your unique financial circumstances.

How Employees Can Save on Tax?

While there is not much you can do to save tax if you choose the new tax regime (only investments in National Pension System NPS are allowed), if you choose the old tax regime, below are some ways that can reduce your taxable income.

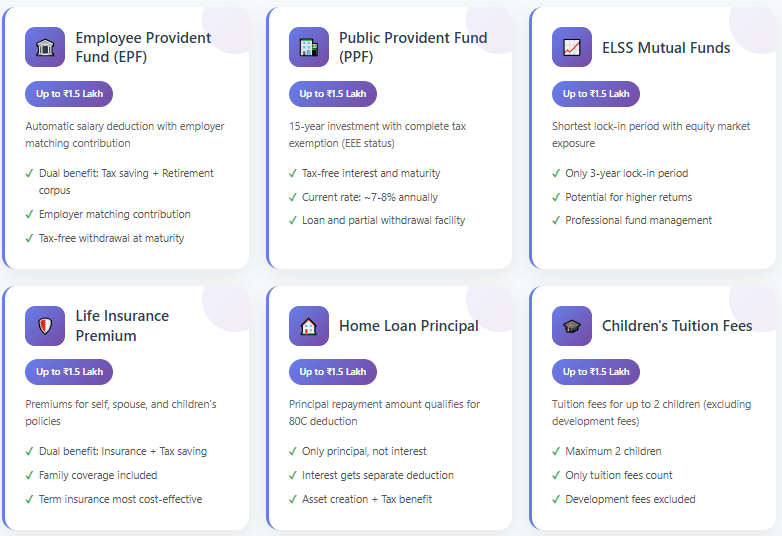

Maximizing Section 80C Deductions

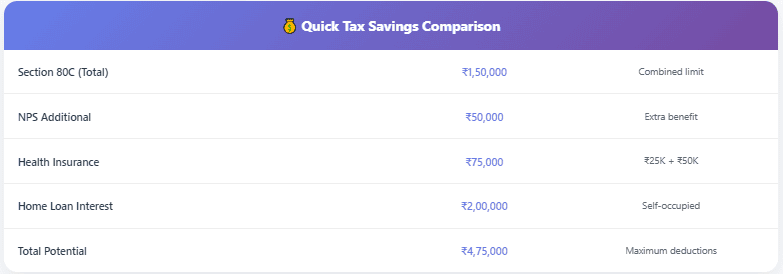

Section 80C offers significant tax-saving opportunities, with a maximum deduction limit of ₹1.5 lakh. Let's explore the various options available under this section:

A. Investment Options Under Section 80C

Employee Provident Fund (EPF): A portion of your salary is automatically invested, with your employer providing a matching contribution. This serves as both a tax-saving measure and a retirement savings vehicle.

Public Provident Fund (PPF): This is a 15-year investment option. The interest earned and the maturity amount are tax-free, with an annual investment limit of ₹1.5 lakh.

Equity-Linked Savings Scheme (ELSS): This mutual fund option has a 3-year lock-in period and offers potential for high returns alongside tax benefits.

National Savings Certificate (NSC): A government-backed savings bond with a 5-year lock-in period, offering a safe investment option.

Tax-Saving Fixed Deposits: These are bank deposits with a 5-year lock-in period, suitable for risk-averse investors.

Life Insurance Premiums: Policy premiums paid for yourself, spouse, and children.

B. Non-Investment Items Eligible Under Section 80C

Children's Tuition Fees: Tuition fees (excluding development fees or donations) for up to two children can be claimed under 80C.

Principal Repayment of Home Loan: The principal amount repaid on your home loan is eligible for deduction under 80C.

IV. Additional Tax-Saving Avenues Beyond Section 80C

While Section 80C is an important component of tax planning, there are several other avenues to further reduce your tax liability:

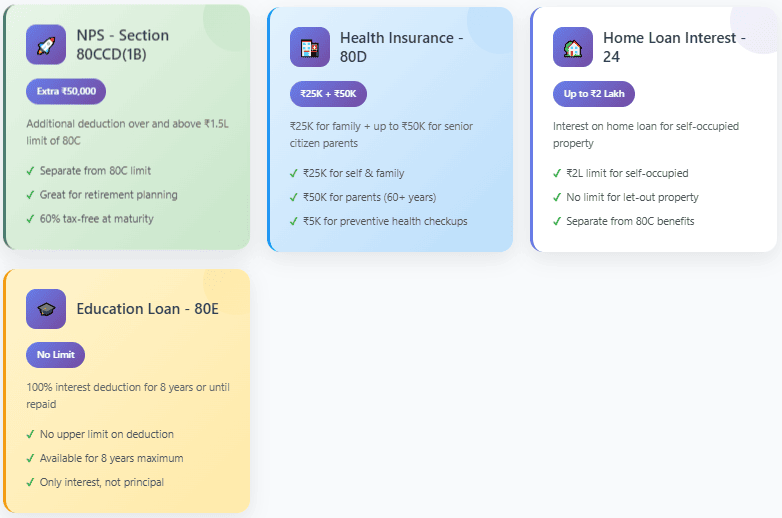

A. National Pension System (NPS) - Section 80CCD

The NPS offers additional tax benefits and serves as a long-term retirement planning tool:

Additional ₹50,000 Deduction: Under Section 80CCD(1B), you can claim an extra deduction of up to ₹50,000 for NPS contributions over and above the ₹1.5 lakh limit under 80C.

Employer's NPS Contribution Benefits: If your employer contributes to your NPS account, up to 10% of your salary (basic + DA) contributed by your employer is tax-free.

Tax Treatment on Maturity: At the time of withdrawal, 60% of the corpus is tax-free. The remaining 40% must be used to purchase an annuity.

B. Health Insurance Premiums - Section 80D

Investing in health insurance not only provides financial security but also offers tax benefits:

Deductions for Self and Family: You can claim up to ₹25,000 for health insurance premiums paid for yourself, your spouse, and your children.

Additional Deductions for Parents: If you're also paying premiums for your parents, you can claim an additional ₹25,000. This limit increases to ₹50,000 if your parents are senior citizens.

Preventive Health Check-ups: Up to ₹5,000 spent on preventive health check-ups for yourself and your family (including parents) is eligible for deduction within the overall limits of Section 80D.

C. Home Loan Interest - Section 24

For homeowners, the tax benefits on home loans can be substantial:

Deduction up to ₹2 lakhs for Self-Occupied Property: If you've taken a home loan for a house you occupy, you can claim up to ₹2 lakhs as a deduction on the interest paid.

Additional Benefits for Let-Out Properties: For let-out properties, there's no upper limit on the interest deduction. However, if this leads to a loss under the head 'Income from House Property,’ you can only set off up to ₹2 lakhs against other heads of income in the same year. The remaining loss can be carried forward for up to 8 years.

D. Education Loan Interest - Section 80E

To encourage higher education, the government offers tax benefits on education loans:

100% Deduction on Interest: The entire interest paid on your education loan is deductible, with no upper limit.

Duration of Benefit: You can claim this deduction for a maximum of 8 years or until the interest is fully repaid, whichever is earlier.

E. Donations to Charitable Institutions - Section 80G

Charitable donations not only contribute to social causes but also offer tax benefits:

Varying Deduction Rates: Depending on the institution you donate to, you can claim deductions ranging from 50% to 100% of the donated amount.

Documentation: Ensure you obtain valid receipts for your donations, as these are required for claiming the deductions.

How Employees Can Structure Their Salary for Tax Efficiency?

As an employee, you can also save taxes by optimizing your salary structure:

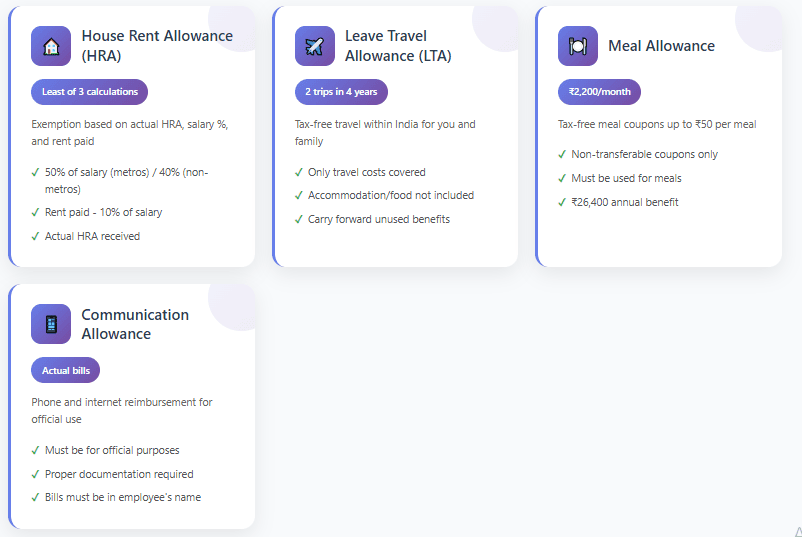

A. House Rent Allowance (HRA)

For those living in rented accommodation, HRA can provide substantial tax benefits:

Calculating HRA Exemption:

The exempt portion of HRA is the least of:

Actual HRA received

50% of (Basic Salary + Dearness Allowance) for those living in metro cities (40% for non-metros)

Actual rent paid minus 10% of (Basic Salary + Dearness Allowance)

Documentation Required for HRA Claims:

Rent receipts or rent agreement

Landlord's PAN if annual rent exceeds ₹1 lakh

Note: Even if your employer doesn't provide HRA, you may still claim a deduction under Section 80GG if you're paying rent.

B. Leave Travel Allowance (LTA)

An LTA can help you save tax on your vacation travel expenses:

Rules and Limitations of LTA Claims:

LTA is exempt for 2 journeys in a block of 4 calendar years

Only covers travel costs for you and your family within India

Does not cover accommodation or food expenses

Strategies for Maximizing LTA Benefits:

Plan your trips to coincide with the LTA cycle

Maintain all travel tickets and boarding passes as proof

Unused LTAs in a block can be carried forward to the first year of the next block

C. Meal Coupons and Other Tax-Free Allowances

Food Coupons/Cards:

Up to ₹50 per meal or ₹2,200 per month is tax-free

Must be non-transferable and usable only for meals

Telephone and Internet Reimbursements:

Actual bills can be reimbursed tax-free if used for official purposes

Maintain detailed bills as proof

Books and Periodicals Allowance:

Can be tax-free if it's for official use and proper documentation is maintained.

To achieve an efficient salary structure, it's advisable to work closely with your HR department.

Conclusion

Remember, tax planning is not about evading taxes, it's about being smart with your money. By planning taxes, you can reduce your taxable income. However, first understand your financial condition in order to plan your investments and save for your future while also saving on taxes.