Health insurance in India operates like a multi-layered safety net. Most people understand basic health insurance, but many overlook a simple tool that can improve coverage at minimal cost: super top-up policies. The question isn’t whether you need one. It is whether you understand the mathematics well enough to make the right decision.

To help you, in this article, we have covered all you need to know about top up as well as super top up policies. Let’s get started.

Understanding the Insurance Coverage Hierarchy

Let’s start with the basics. Think of your health insurance like a building with multiple floors. Your base policy is the foundation. A top-up is an additional floor that only activates when a single claim exceeds a specific threshold. A super top-up is smarter; it activates when your total yearly claims exceed the threshold, regardless of how many hospitalisations you have.

Here is an example. You have a ₹5 lakh base policy with a ₹5 lakh deductible super top-up.

Scenario 1: One hospitalisation costs ₹8 lakhs. Your base covers ₹5 lakhs, super top-up covers ₹3 lakhs. You’re protected.

Scenario 2: Two hospitalisations cost ₹3 lakhs and ₹4 lakhs (₹7 lakhs total). Your base covers ₹5 lakhs, super top-up covers ₹2 lakhs. Again, protected.

With a regular top-up, Scenario 2 would leave you exposed because neither individual claim exceeds ₹5 lakhs.

The deductible is the amount you pay out-of-pocket before the super top-up kicks in. This is the critical lever that determines both your premium and your protection level.

It is calculated as

Key principle: Higher deductible = Lower premium, but higher out-of-pocket risk.

Common deductible options in India range from ₹3 lakhs to ₹10 lakhs. Your base policy typically covers this deductible amount, so the super top-up only activates after your base policy is exhausted or when cumulative claims exceed the deductible.

Medical inflation in India runs at 12-15% annually, significantly higher than general inflation.

As a result, most financial advisors recommend total coverage (base + super top-up) of at least ₹25-30 lakhs for individuals and ₹50 lakhs for families, accounting for medical inflation over the next decade.

The Mathematics of Risk Assessment

Understanding the risk level is important to buy a super top up policy. Here are some factors that you should consider.

1. Probability Analysis: When Do You Actually Need Coverage Beyond Your Base?

This is where most people make emotional decisions instead of mathematical ones. The probability of exceeding your base coverage is far lower than the probability of hospitalisation itself.

If you have a ₹5 lakh base policy, the probability of a single claim exceeding ₹5 lakhs is lower for those under 45-50, and higher for those over 50. This is where super top-ups become crucial. They protect against a specific, quantifiable risk at a fraction of the cost of increasing your base coverage. This is also true as with age, the base coverage premium also increases and the super top up in comparison becomes more affordable.

2. Cost-Benefit Equation: The Premium-to-Coverage Ratio

The true value of insurance isn’t measured by what you pay, it’s measured by what you get for what you pay. Most Indians overspend on health insurance by focusing exclusively on base policies while overlooking the efficiency of super top-ups. Say you wish to have a cover of ₹25 lakhs. Here is how super top up can be a value addition and cost-effective.

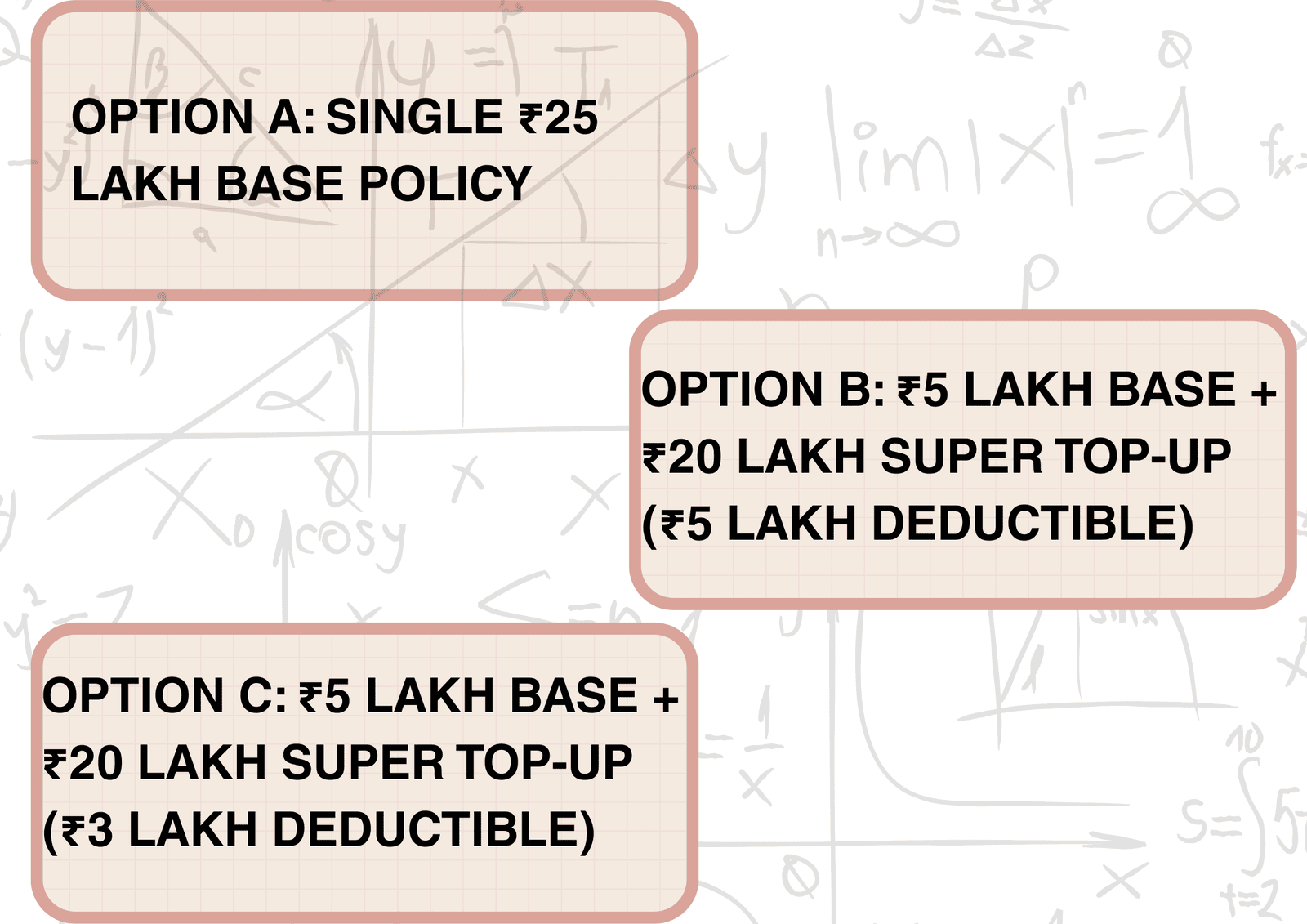

Option A: Single ₹25 lakh base policy

Annual premium: ₹35,000-37,000 for a person in their 40s

No deductible

Simple but extremely expensive

Option B: ₹5 lakh base + ₹20 lakh super top-up (₹5 lakh deductible)

Base premium: ₹12,000

Super top-up premium: ₹3,500-4,500

Total: ₹15,500-16,500

Annual savings: ₹19,500-21,500 (55-60%)

Option C: ₹5 lakh base + ₹20 lakh super top-up (₹3 lakh deductible)

Base premium: ₹12,000

Super top-up premium: ₹6,000-7,000

Total: ₹18,000-19,000

Lower deductible but still substantial savings

Option B provides identical protection at nearly half the cost. Over 20 years, you save ₹4-4.3 lakhs, enough to cover your deductible multiple times over. Your base policy covers the deductible, so there’s no additional out-of-pocket cost.

3. The Aggregation Advantage: Why Multiple Claims Matter

This is the feature that makes super top-ups crucial to regular top-ups for most Indian families.

You have a ₹5 lakh base policy and a ₹10 lakh super top-up with a ₹5 lakh deductible.

Year 1: Father hospitalised for ₹3 lakhs, mother for ₹2.5 lakhs (total ₹5.5 lakhs)

Base covers: ₹5 lakhs

Super top-up covers: ₹0.5 lakhs

Your cost: ₹0

Same scenario with regular top-up: You’d pay ₹2.5 lakhs out-of-pocket because neither individual claim exceeded ₹5 lakhs.

This aggregation feature is critical for families with multiple members or those with chronic conditions requiring multiple treatments annually.

What to Consider When Making the Decision?

Here are things you should consider while buying a super top up.

1. Age-Based Considerations

Your age fundamentally changes the mathematics:

Under 40 with no family history of chronic illness:

Super top-up makes sense if your base coverage is ₹10 lakhs or less

Recommended deductible: ₹5-7 lakhs (lower premium, manageable out-of-pocket)

40-50 with emerging health concerns:

Super top-up becomes essential

Recommended deductible: ₹3-5 lakhs (balance between premium and protection)

50+ or with pre-existing conditions:

Super top-up is non-negotiable mathematically

Recommended deductible: ₹2-3 lakhs (higher out-of-pocket manageable given higher claim probability)

2. Family Floater vs. Individual Policies

A family floater super top-up is better than individual policies for most families because:

Deductible aggregation: The ₹5 lakh deductible applies to total family claims, not per person

Premium efficiency: One family floater costs 30-40% less than individual policies for each member

Flexibility: Any family member can use the full coverage

3. Pre-Existing Conditions

Pre-existing conditions create waiting periods (typically 2-4 years) before coverage applies. Consider if:

If you have a pre-existing condition, the super top-up’s value is delayed but not eliminated

The waiting period clock resets if you switch insurers, so choose carefully

Some insurers offer reduced waiting periods (12-24 months) at higher premiums. Calculate whether this premium increase is worth the earlier coverage.

Optimising Your Insurance Portfolio

There are three things that can help you optimise your portfolio.

1. The Ideal Deductible Threshold

The deductible decision is purely mathematical once you know three numbers:

Your annual out-of-pocket capacity: How much can you comfortably pay in a medical emergency?

Your base coverage: What’s your existing health insurance limit?

Your risk profile: What’s the probability you’ll need coverage beyond your base?

Decision framework:

If annual out-of-pocket capacity ≥ ₹7 lakhs: Choose ₹7-10 lakh deductible (lowest premium)

If annual out-of-pocket capacity = ₹5 lakhs: Choose ₹5 lakh deductible (balanced)

If annual out-of-pocket capacity = ₹3 lakhs: Choose ₹3 lakh deductible (higher premium, lower risk)

Most people overestimate their out-of-pocket capacity. If you’ve never paid ₹5 lakhs out-of-pocket for anything, don’t choose a ₹5 lakh deductible just to save ₹1,000 annually.

2. Premium Escalation Projections

Super top-up premiums increase with age. This is critical for long-term planning.

Buying a super top-up at 40 locks in lower premiums than waiting until 50. The premium difference between buying at 40 vs. 50 is enormous.

Some policies offer level premiums after age 60 (no further increases), which provides valuable certainty in retirement planning.

3. The Claim Settlement Ratio

Not all insurance premiums are equal. An insurer with an 85% claim settlement ratio means only 85 out of 100 people got the cover disbursal.

Key metrics to evaluate:

Claim settlement ratio by count: Percentage of claims settled (target: >85%)

Claim settlement ratio by value: Percentage of claim amount settled (target: >85%)

Claim repudiation ratio: Percentage of claims rejected (target: <5%)

Settlement efficiency: Claims settled within 30 days (target: >90%)

Check the Insurance Regulatory and Development Authority (IRDA) annual reports or individual insurer disclosures. This single metric often determines whether a super top-up is truly valuable.

Conclusion

Super top-up policies make financial sense for most Indians, but only if you approach the decision mathematically rather than emotionally. The key is understanding that you’re not buying comprehensive coverage, you’re buying protection against a specific risk: exceeding your base policy limits.

The real cost of not having a super top-up isn’t the premium you save, it’s the a few lakhs you might pay out-of-pocket when a single hospitalisation exceeds your base coverage. In financial mathematics, that’s called catastrophic risk. Super top-ups exist to eliminate it affordably.