This year, we have already seen a lot, from market hikes to falls, geopolitical tensions to Trump Tariffs, and more. The markets have been volatile, inflation has been persistent, and economic uncertainties continue to loom over our heads.

Now that we are past the half-year mark, have you wondered how all these factors have impacted your financial progress? A half-yearly financial health check can be the difference between achieving your financial goals and falling short. In this article, let’s explore how a simple 5-minute assessment can potentially transform your financial trajectory for the remainder of the year.

Why Should You Do a Half-Yearly Review of Your Finances?

A financial health check isn’t a set-and-forget exercise. The economic landscape is constantly evolving, and so are your personal circumstances. A mid-year review allows you to:

Identify potential problems before they become critical. Early problem detection allows for prompt intervention. Identifying an unsustainable spending pattern in June rather than waiting until March of the next financial year provides nine additional months to implement corrective measures.

New opportunities emerge constantly in India’s evolving financial landscape. The first half of 2025 has witnessed shifts in the Reserve Bank of India’s monetary policy stance, changes in mutual fund regulations, and adjustments in small savings rates. A mid-year review ensures your portfolio remains positioned to capitalise on these developments.

Personal circumstances evolve throughout the year. Job changes, family responsibilities, and unexpected expenses necessitate financial strategy adjustments. The half-yearly checkpoint provides the perfect opportunity to realign your approach with current realities.

Tax planning in India requires year-round attention. Strategic decisions regarding investments under Section 80C, health insurance premiums under Section 80D, and home loan interest deductions can substantially reduce your tax liability when planned in advance.

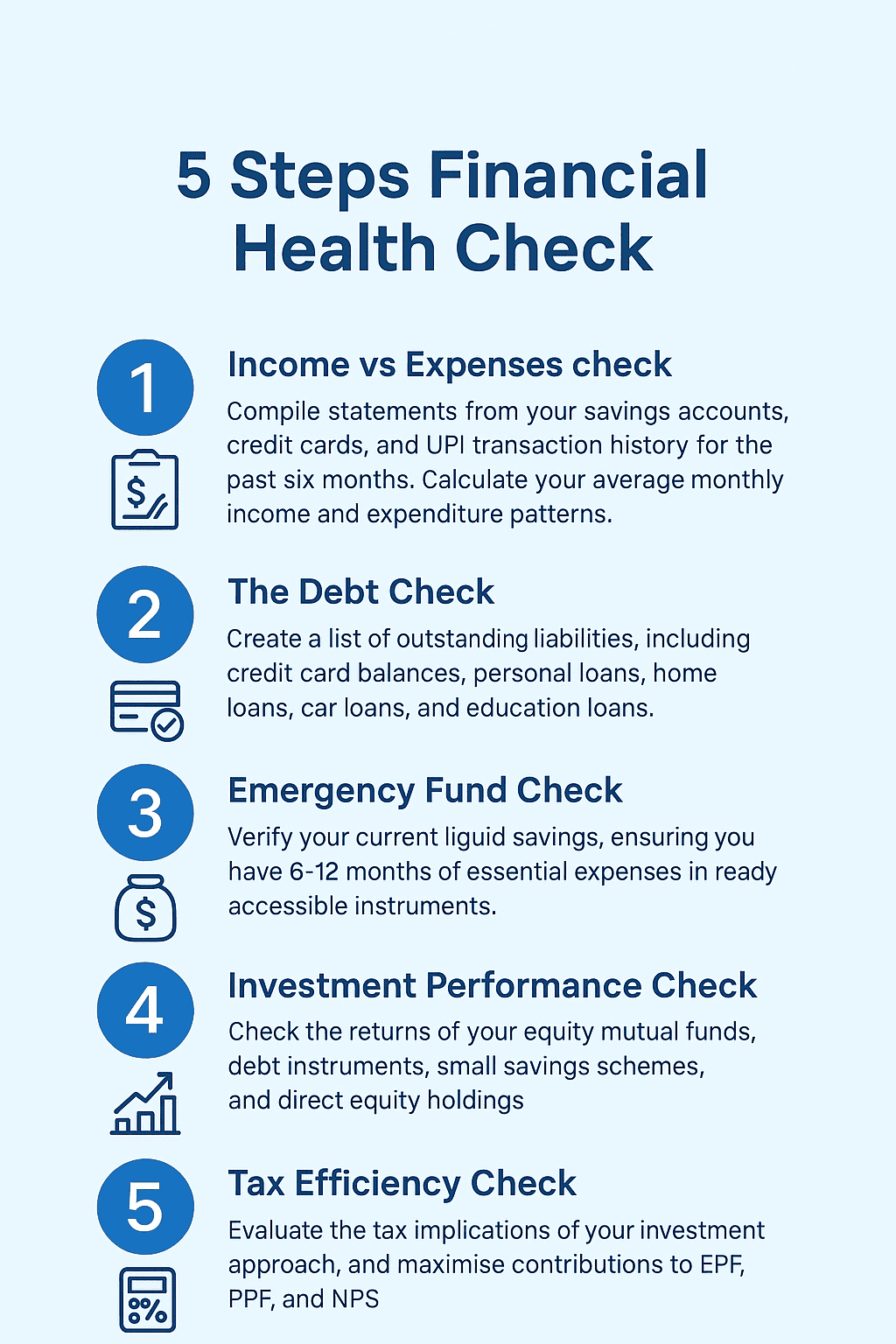

5 Steps Financial Health Check

With just five minutes of focused attention on each of these key areas, you can gain clarity on your financial position.

1. Income vs Expenses check

Compile statements from your savings accounts, credit cards, and UPI transaction history for the past six months. Calculate your average monthly income and expenditure patterns. A healthy financial position demands that your income consistently exceeds your expenses.

You may have experienced compensation restructuring, performance bonus adjustments, or variable pay modifications since April. These changes must be factored into your revised financial projections.

This also impacts your savings rate calculation. Your monthly SIP commitments should be reviewed against your current income to ensure they remain sustainable while maximising wealth creation potential. Understand that “It’s not your salary that makes you rich, it’s your spending habits.”

2. The Debt Check

Create a list of outstanding liabilities, including credit card balances, personal loans, home loans, car loans, and education loans. For each debt, note the current outstanding amount, applicable interest rate, and monthly payment obligation.

High-cost debt identification demands immediate attention. With current lending rates in India, any debt carrying interest above 12%, particularly personal loans and credit card balances, should be prioritised for accelerated repayment.

3. Emergency Fund Check

Emergency fund assessment requires verification of your current liquid savings. You should have 6-12 months of essential expenses in readily accessible instruments, such as savings accounts, liquid funds, or fixed deposits with sweep-in facilities.

The half-yearly review provides an opportunity to evaluate whether your emergency fund is positioned in high-yield savings accounts, liquid mutual funds, or short-term fixed deposits to balance accessibility with reasonable returns.

Also, do an inflation adjustment of emergency funds to ensure your safety net maintains its purchasing power. With inflation running above 5% in India, your emergency fund should grow proportionally to preserve its real value.

4. Investment Performance Check

Portfolio performance review includes checking the returns of your equity mutual funds, debt instruments, small savings schemes, and direct equity holdings. Compare these returns against appropriate benchmarks such as Nifty 50, Nifty Next 50, or relevant mutual fund category averages.

This makes sure that your investment mix remains aligned with your risk tolerance and financial goals.

5. Tax Efficiency check

Tax-efficiency review ensures your investment approach minimises tax liability. With recent changes in capital gains taxation in India, such as debt funds’ treatment as per tax slab and increase in Long-term Capital Gains Gains (LTCG) to 12.50% from 10% on income above Rs. 1.25 lakh annually, and Short-term Capital Gains (STCG) increasing to 20% for equity instruments, reassessing the tax implications of your investment strategy becomes particularly important.

Investment contributions through EPF, PPF, and NPS should be maximised to leverage their tax advantages and long-term wealth creation potential if you have chosen the Old Tax Regime. The mid-year point presents an opportunity to increase voluntary contributions if your cash flow permits.

What to Do After the Health Check?

Below is your focused action plan:

(Note: The potential impact amount is for example purposes only. The real amount depends on your personal circumstances.)

Conclusion

The half-yearly financial health check tells you about your financial health and what you can do to improve it. Financial well-being emerges not from one-time decisions but from consistent attention and improvements. Remember that there is always room for improvement, and you can leverage it for your financial future. After all, “What gets measured, gets managed.”