Fixed Deposits (FDs) have traditionally been the go-to choice for many Indian investors seeking safety and predictable returns. However, bonds are not lagging behind and becoming popular for their better returns compared to FDs, particularly in high-inflationary periods.

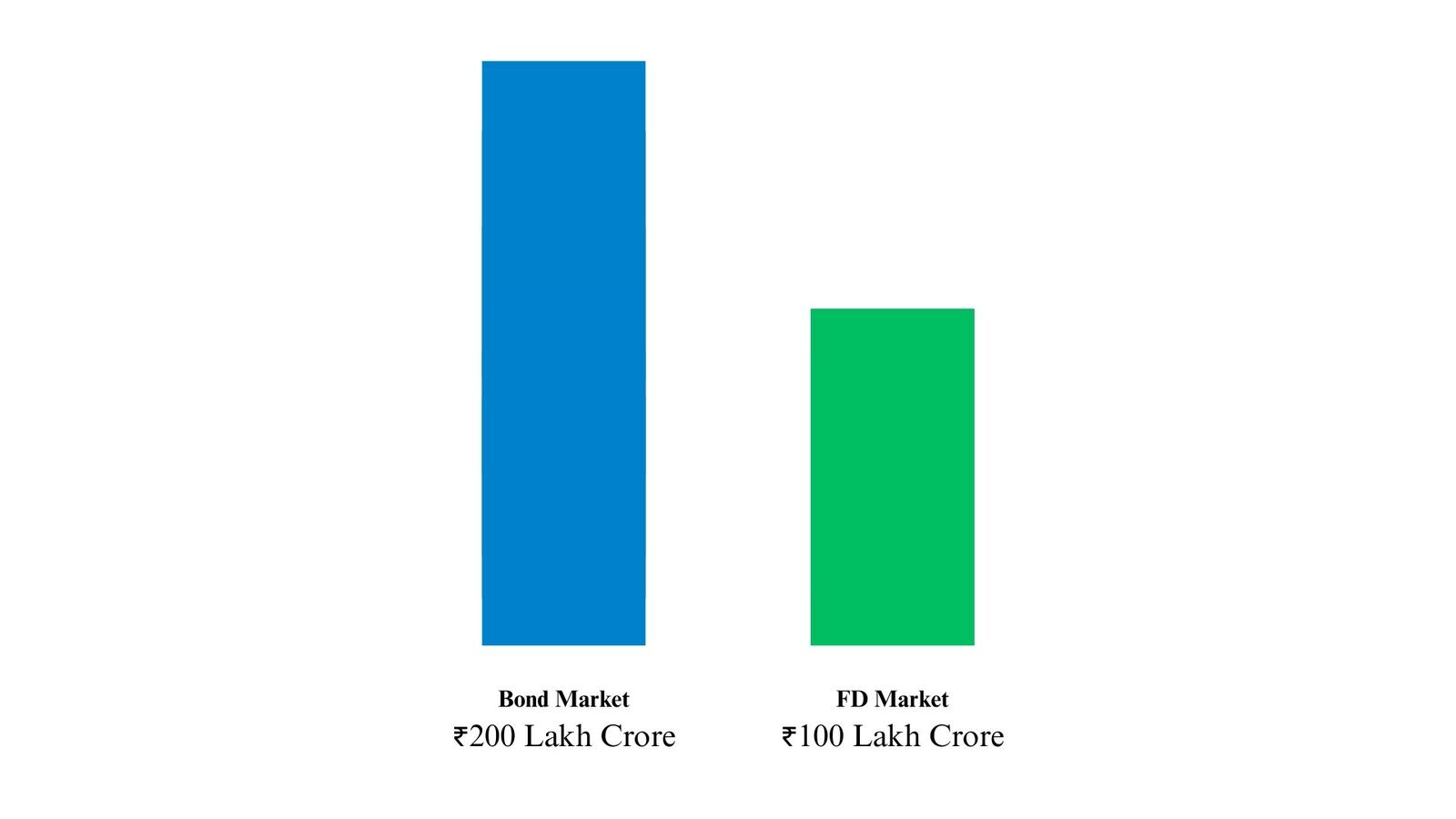

The Indian bond market has grown significantly to reach ₹200 lakh crore. Compared to this, the FD market size is only ₹100 lakh crore.

The question is, does market size matter, and how do these two investment instruments compare, and which one might be better suited for your financial goals? Let’s find out in this article.

Understanding Bonds

Let’s start with bonds first. What Are Bonds? Bonds are debt instruments where you lend money to an issuer, such as the government, municipality, or corporation, for a fixed period. You receive a fixed rate of interest known as the coupon rate. On maturity, you also get your initial investment amount, which is the bond’s face value.

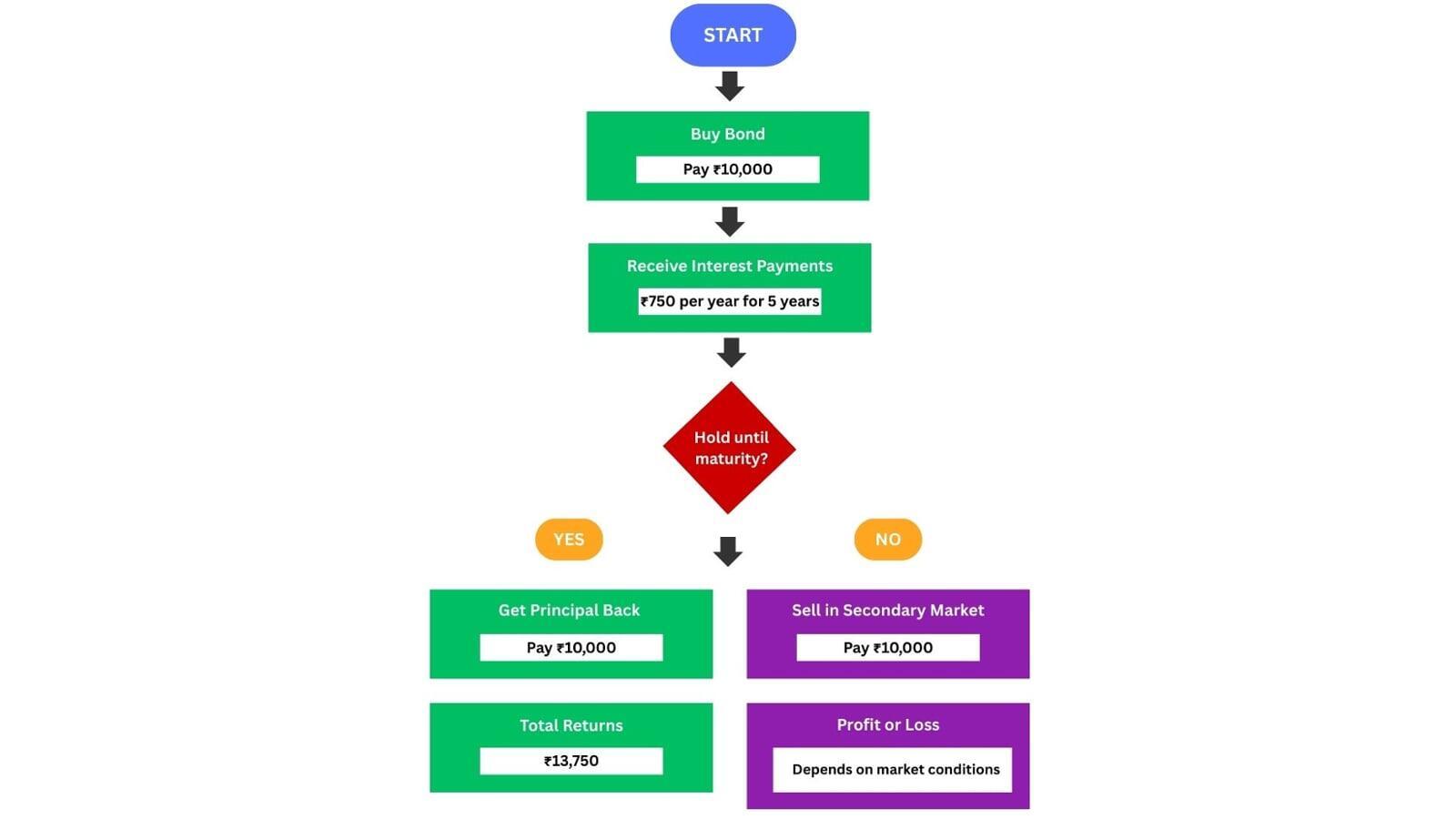

Let’s understand with this example. You purchase a 5-year corporate bond with a face value of ₹1,000 and a coupon rate of 7.5%, requiring a minimum investment of ₹10,000 (10 bonds). Here’s what happens:

You pay ₹10,000 upfront to the issuer.

You receive interest payments of ₹750 annually (7.5% of ₹10,000), typically in semi-annual instalments of ₹375 each.

After 5 years, you receive your principal amount of ₹10,000 back.

The bond market also has a secondary market where investors can sell their bonds before maturity, though prices may fluctuate based on prevailing interest rates and the issuer’s credit quality. For instance, if interest rates rise to 8.5%, your 7.5% bond would trade at a discount to face value since newer bonds offer better returns.

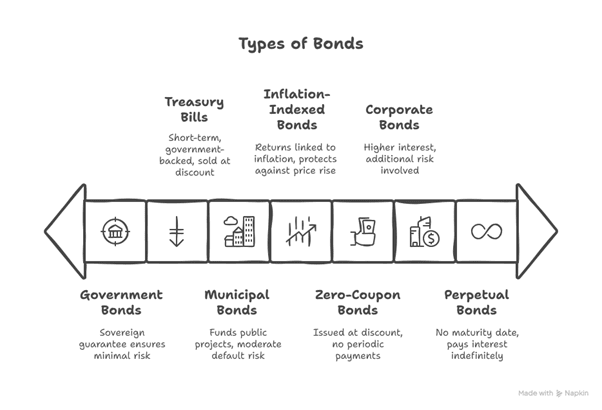

Types of Bonds

Understanding Fixed Deposits (FDs)

What Are Fixed Deposits? Fixed Deposits are time deposits offered by banks and financial institutions where you deposit a lump sum for a fixed tenure at an agreed interest rate.

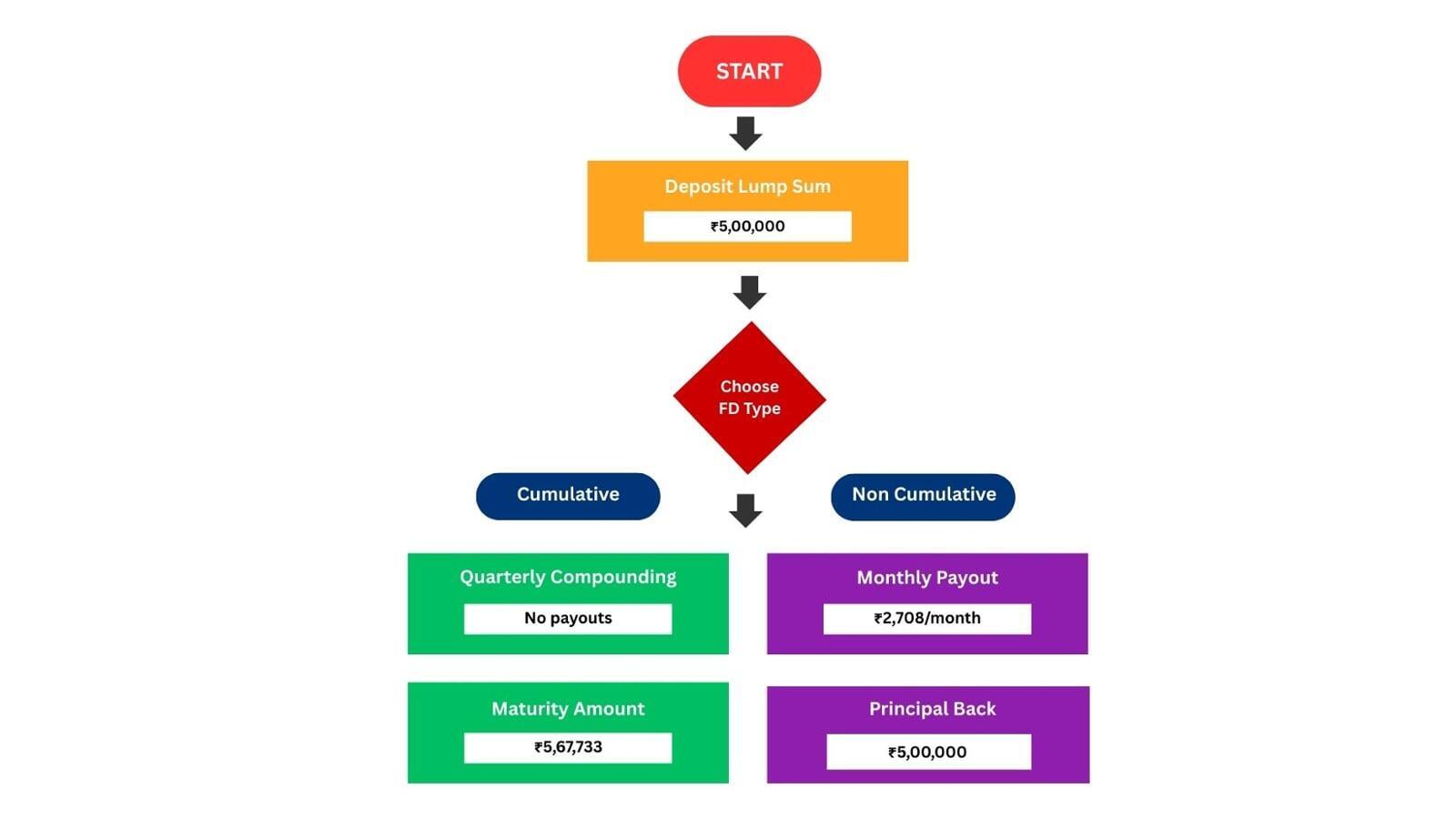

For example, if you deposit ₹5,00,000 for 2 years at 6.5% annual interest:

For a cumulative FD: Interest is compounded quarterly. At maturity, you receive approximately ₹5,67,733 (principal + interest).

For a non-cumulative FD with monthly payout: You receive approximately ₹2,708 as interest every month, and your principal of ₹5,00,000 is returned at maturity.

Deposits up to ₹5 lakhs per bank are insured by the Deposit Insurance and Credit Guarantee Corporation (DICGC).

Types of Fixed Deposits

Regular FDs: Standard term deposits with fixed interest rates for specific periods.

Tax-Saving FDs: 5-year deposits that qualify for tax deduction under Section 80C of the Income Tax Act, with a maximum deduction of ₹1.5 lakh per financial year. However, these have a mandatory lock-in period of 5 years.

Senior Citizen FDs: Offer additional interest rates (usually 0.25-0.75% higher) for depositors above 60 years of age.

Cumulative FDs: Interest is compounded and paid at maturity along with the principal.

Non-Cumulative FDs: Interest is paid out at regular intervals (monthly, quarterly, etc.) rather than at maturity.

Flexi Fixed Deposits: Hybrid products that combine the liquidity of savings accounts with the higher returns of FDs.

Corporate FDs: Issued by companies rather than banks, offering higher interest rates but with potentially higher risk.

Comparison Table: Bonds vs FDs

Parameter | Bonds | Fixed Deposits |

Issuer | Government, corporations, municipalities | Banks and financial institutions |

Returns (Current) | G-Secs: 6.35% (10Y) | Public Banks: 5.50-6.50% |

Minimum Investment | Starting from ₹10,000. With a few new-age platforms allowing lower investment entry | Can start from as low as ₹1,000 |

Liquidity | Secondary market trading (variable liquidity) | Premature withdrawal with penalty |

Risk | Credit risk, interest rate risk, liquidity risk | Inflation risk, limited to ₹5 lakh insurance |

Tenure Options | 91 days to 40 years | 7 days to 10 years |

Interest Payout | Usually semi-annual or annual | Monthly, quarterly, annual, or at maturity |

Interest Rate Reset | Fixed for the entire tenure | Fixed for the entire tenure |

Investment Process | Through a broker, exchange, or bond platform | Directly with a bank (branch/online) |

What is Right for You: Bonds or FDs?

The choice between bonds and FDs depends on several factors unique to your financial situation and goals.

Invest in Bonds If:

You’re seeking higher returns than traditional FDs and are willing to accept slightly higher risk.

You’re in a higher tax bracket and looking for potentially better post-tax returns. For an investor in the 30% tax bracket, a taxable bond yielding 7.5% provides an effective yield of about 5.2% after taxes.

You have a medium to long-term investment horizon (3+ years). An investor saving for a goal that is 5 years away can benefit from the higher yields of bonds, potentially generating around 9-10% more corpus compared to FDs.

Safety of the principal is your utmost priority. A risk-averse senior citizen with limited corpus may prioritise bank FDs where the principal is guaranteed and deposits up to ₹5 lakhs are insured.

You need short-term parking of funds (less than 1 year). An individual saving for a near-term goal would be better served by a short-term FD than by bonds, which might face liquidity issues or price volatility if sold before maturity.

You prefer absolute certainty about your returns.

Factors to Consider Before Investing in Bonds vs FDs

Here are three factors to consider when deciding between investing in bonds and FDs

.

.

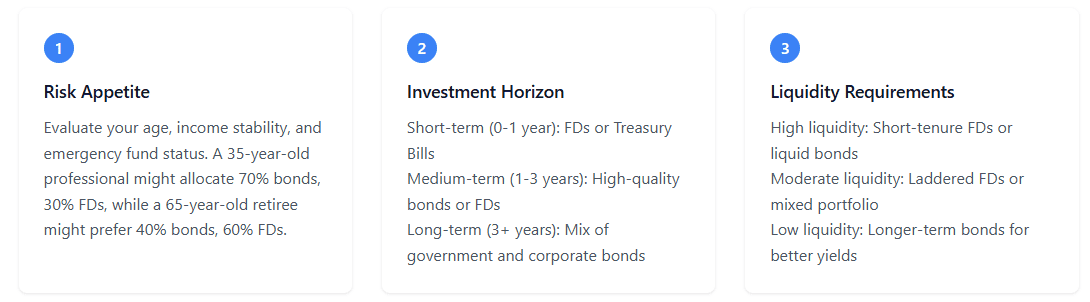

1. Risk Appetite

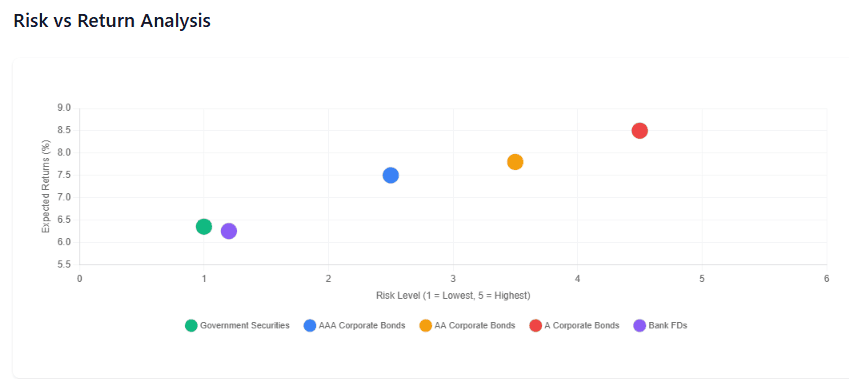

Your tolerance for risk should guide your choice. If you’re risk-averse, stick with high-rated bonds or FDs. If you can tolerate moderate risk for better returns, consider AA or A-rated corporate bonds.

A practical approach is to determine your risk capacity by evaluating:

Your age and time horizon for investments

Your income stability and emergency fund status

Your overall financial goals and portfolio diversification

For instance, a 35-year-old professional with stable income might allocate 70% to bonds and 30% to FDs, while a 65-year-old retiree might prefer a 40% bonds and 60% FDs allocation.

2. Investment Horizon

Match your investment choice with your time horizon:

Short-term (0-1 year): FDs or Treasury Bills offer better certainty

Medium-term (1-3 years): High-quality corporate bonds or bank FDs

Long-term (3+ years): A mix of government and corporate bonds for potentially higher returns

A sound strategy is to create a time-based ladder of investments:

Emergency funds in short-term FDs or liquid funds

Medium-term goals in a mix of FDs and high-quality bonds

Long-term goals primarily in bonds with better yields

3. Liquidity Requirements

Assess how quickly you might need access to your money:

High liquidity needs: Stick with shorter-tenure FDs or highly liquid government bonds

Moderate liquidity needs: Consider laddered FDs or a mix of bonds and FDs

Low liquidity needs: Longer-term bonds will typically offer better yields

Many investors create a three-tier strategy:

High-liquidity tier: Savings accounts and short-term FDs

Medium-liquidity tier: Longer-term FDs with moderate penalties

Low-liquidity tier: Higher-yielding bonds held to maturity

Conclusion

Both bonds and fixed deposits have their place in a well-balanced investment portfolio. FDs offer simplicity, safety, and predictability, making them ideal for conservative investors and short-term goals. Bonds, on the other hand, can provide higher returns and flexibility, especially suited for those with a longer investment horizon and a slightly higher risk tolerance.

The ideal approach would be to maintain a balanced portfolio with both bonds and FDs, allocated according to your specific financial goals, time horizon, and risk tolerance.